The Wild West of cryptocurrency just got a little wilder. Solana, the blockchain known for its lightning-fast transactions, recently became a breeding ground for a peculiar phenomenon: the meme coin frenzy.

While these dog-themed, cat-inspired, or just plain nonsensical tokens promised moon landings, many investors landed face-first in a crater of lost cash.

Solana Stampede: A Frenzy Of Frivolous Finance

Fueled by social media hype and the fear of missing out (FOMO), a stampede of investors poured money into meme coin presales. A project with a name like “I Like This Coin” (LIKE) sprouted like weeds, promising outlandish returns.

The “I Like This Coin” story, however, turned out to be a classic case of “buyer beware.” Despite an initial market cap of a staggering $577 million, the token’s value plummeted by a disastrous 90% within a mere eight hours of launch.

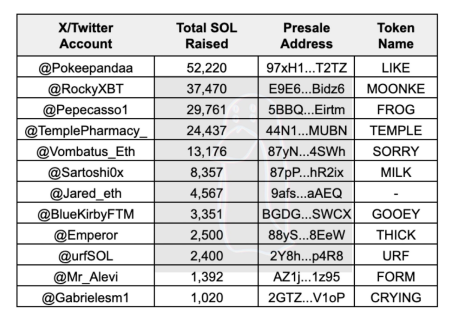

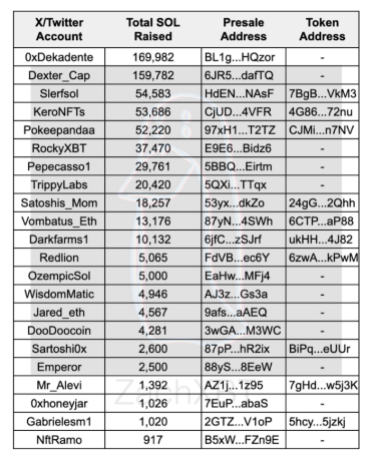

The party didn’t stop there. Blockchain investigator ZachXBT uncovered a particularly galling trend: a dozen meme coin projects vanished into thin air after their presales, taking a combined $26.7 million from investors with them.

Only 1 month has passed and 12 of the Solana presale meme coins have been completely abandoned after raising >180,650 SOL ($26.7M).

Would avoid any future projects launched by these founders. https://t.co/J0zFldRIa6 pic.twitter.com/K610MAEPMn

— ZachXBT (@zachxbt) April 21, 2024

Solana Slowdown: When Meme Mania Clogs The Network

The meme coin craze wasn’t without collateral damage. The massive influx of transactions clogged the Solana network, leading to transaction failures and frustrating delays. This highlighted a fundamental issue with meme coins: they often lack real-world applications and contribute little to the underlying blockchain’s development.

Solana’s founder, Anatoly Yakovenko, wasn’t shy about expressing his skepticism. He questioned the very concept of meme coin presales, suggesting they were better suited for projects with strong tech foundations. Yakovenko’s comments resonated with many who saw the meme coin frenzy as a speculative bubble fueled by empty promises and social media hype.

Solana is currently trading at $155.69. Chart: TradingView

Meme Coin Meltdown: A Cautionary Tale For Crypto Curious Investors

The rise and fall of Solana’s meme coins serves as a stark reminder of the inherent risks associated with investing in unregulated, highly speculative assets. While the allure of quick riches might be tempting, the potential for scams and rug pulls (where developers abandon a project after raising funds) is significant.

The fallout from the meme coin frenzy could have lasting repercussions. Regulatory bodies might take a closer look at this corner of the crypto world, potentially leading to stricter measures to protect investors.

For those interested in exploring the exciting world of cryptocurrency, the lesson is clear: conduct thorough research, prioritize projects with real-world use cases, and always remember what the sages mean when they say if it sounds too good to be true…

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.