Forex trading can be a lucrative source of income, but it requires time, effort, and skill. While some traders have been successful in trading Forex, many have failed to achieve consistent profits despite using advanced tools and strategies, including automated trading systems or Expert Advisors (EA).

here are some reasons why traders fail to make money using good EA:

1-Not understanding how the EA works: the first reason I see many traders fail to make money using EA, is not understanding how EA works, what is the strategy used to place trades, and how this will hugely affect the traders using the Ea, it’s true that using EA eliminate the emotion involved in trading, but if you don’t trust and understand the strategy used in the EA, there will be still emotion involved which leads to the trader getting involved in manually changing the setting of the EA every once and while leading to inconsistent results.

2-Lack of Understanding of Market Fundamentals: Forex trading requires a thorough understanding of market fundamentals such as interest rates, economic indicators, and geopolitical events. Traders who do not have a solid grasp of these fundamentals may find themselves making random decisions based on emotion alone

3-Risk Management: Risk management is crucial in forex trading. Traders who do not understand how an EA works may find themselves changing risk many times, taking too much leverage, or which can lead to significant losses. and after balm it on the EA being a history reader or a scam, etc An EA may not be able to account for all the risks involved in trading, and traders must take responsibility for their risk management.

4-Lack of Discipline: everything I mentioned earlier leads to one another, Forex trading requires discipline, patience, and persistence. Traders who lack discipline may find themselves making impulsive decisions, chasing losses, or not sticking to their trading plan. An EA can only execute trades based on pre-defined rules, but it cannot account for the trader’s emotions and behavior, while the traders keep changing their minds every day and changing the EA setting

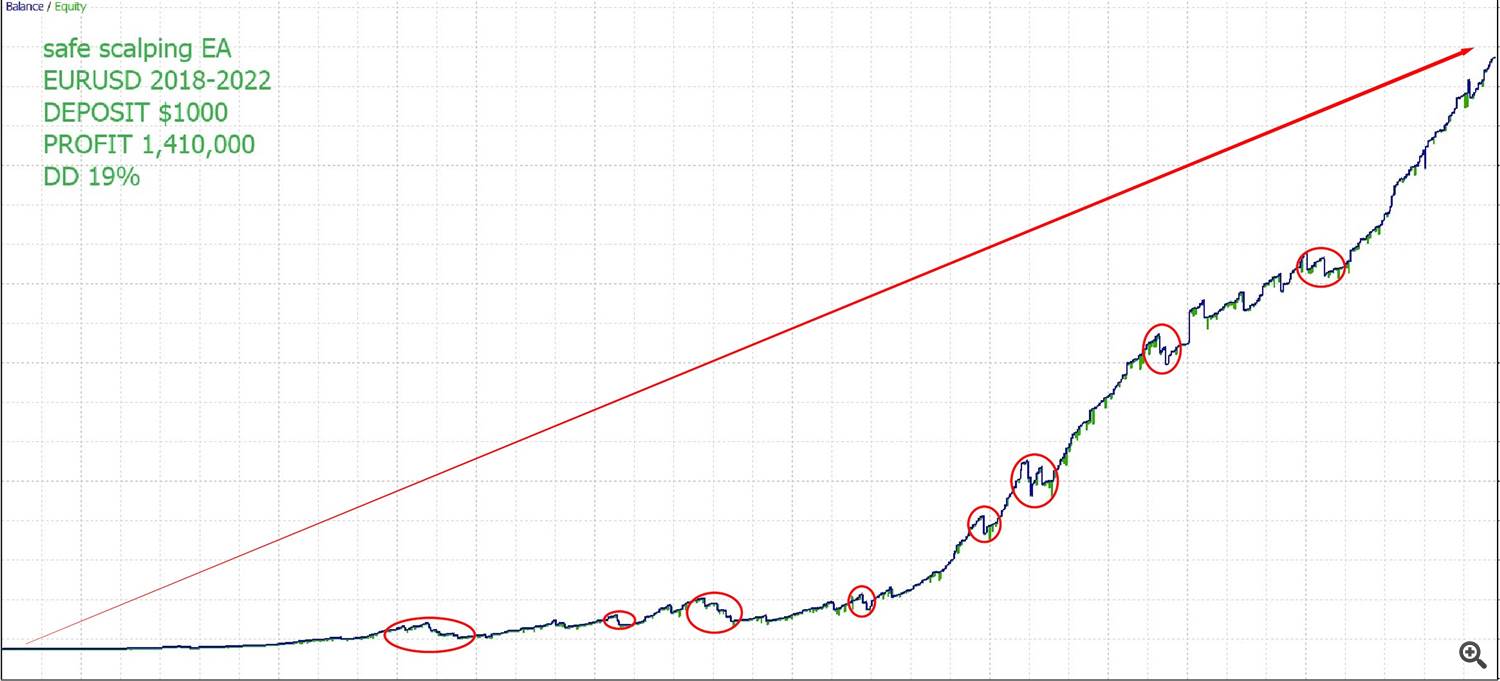

traders who don’t understand that, find themselves chasing one EA after the other because what will happen when traders purchase an Ea and get into a drawdown after buying, similar to the one highlighted with a circled on the attached photo, probably most traders will delete the EA from the chart, give it a bad rating, go on to buy another EA, and repeat the same, i met some traders that have bought every 40 expert advisors and spent huge sums of money chasing the next EA in a loop taking the same action again and again, and i am willing to bet the money spent on buying Ea, is more than what they have in their trading account

Look at the photo I shared here, Traders must know themselves in advance, and know how they will react when an EA goes into a drawdown period, are they going to quit and try another EA or be patient and disciplined, wait for the EA to recover and be back to making profit, which some of these period could take weeks to few months, but if one will check from start to end, the Ea made money, but we all fail to ask ourselves this question, how we will react when the Ea is in drwasown? are we going to be using the EA when it is back to make profit? simple questions

but the bigger picture if the strategy used in an EA is understandable and valid, it can perform well in the long term as shown in the attached picture.

Thanks for Reading