There are hundreds of trading books out there and every book promotes a different approach to trading and how to find the best trading opportunities. But there is one thing that all traders agree on and it’s that you have to have a trading journal in order to become a profitable trader.

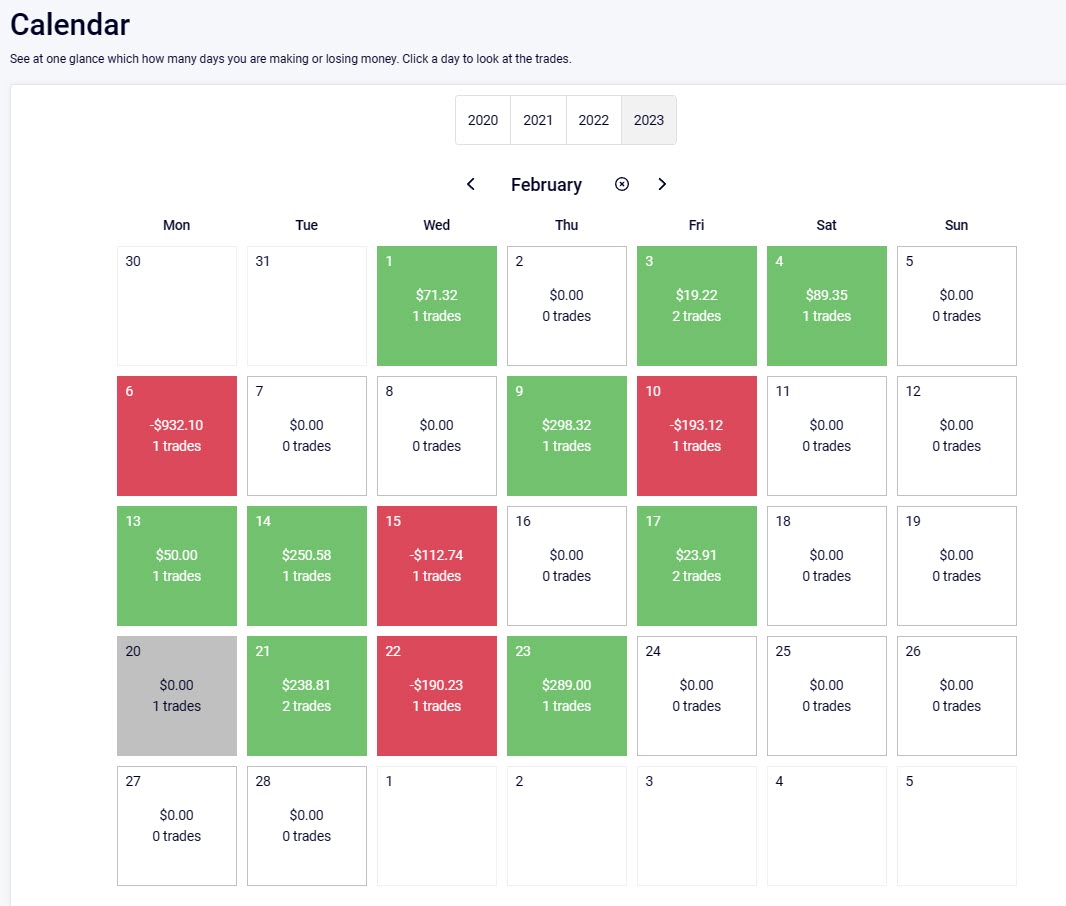

Just ask yourself right now: Do you remember your last 10 or 20 trades? Do you remember what went wrong and what you should have done? Can you recall what you did particularly well and what you need to do more of? Which mistakes do you keep repeating, when, and how much are they costing you? I could go on forever, but I am sure you get the point.

Of course, no one will be able to recall all their previous trades from the top of their head. But how can you expect to become a better trader if you do not know where to improve and how to do it?

In the end, trading is like running a business. And no business will survive if the owner does not know the numbers. If you do not know your revenue, how much your costs are, what your profits are, which your best-selling product is, and how much tax you owe, of course, you cannot run a successful business. I think we can all agree on that. In trading, it works just like that too.

Why do traders lose?

The failure rate among traders is above 95%. Only very few traders actually make it. Why is that?

Without a trading journal and without being able to review what they have been doing, traders are doomed to repeat the same mistakes and also draw the wrong conclusions about why they are not succeeding.

System-hopping (changing trading systems all the time, hunting for the one perfect system that will just make money) is the result when traders focus on the wrong things.

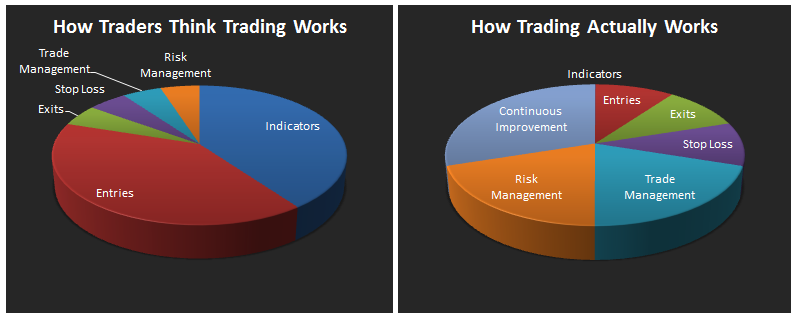

Many traders wrongly believe that their entry timing is to blame and that they just have to find a better way of picking the best trading opportunities.

We have analyzed hundreds of trading journals and the reality looks very different. It is not because traders have an inefficient way of picking trades that is keeping them from becoming profitable, but a variety of other issues:

- Closing winning trades too soon

- Letting losses get out of hand

- Micro-managing trades

- Trading without discipline

- Getting emotional

- Inconsistent risk management

And a few others.

What a good trading journal does for you

So far, conventional trading journals have been very dull and also did not really provide the tools needed. Especially the self-made Excel spreadsheets sooner or later end as data graveyards and we forget about them because they do not provide actionable tips.

Here are the three most important points when it comes to having a good trading journal:

- A trading journal holds you accountable and makes you more aware of your trading. Trading can be a lonely profession at times. But once you start keeping a trading journal, you will see how it functions as an invisible mentor and your accountability partner.

- One size fits all doesn’t work when it comes to trading journals. Every trader has unique requirements, thinks slightly differently, and also faces different issues. That’s why a good trading journal should be customizable.

- The feedback from your trading journal needs to be actionable. Writing down your thoughts in a notebook or writing how much money you won or lost in a random Excel spreadsheet may sound like a good idea, but it leads to nowhere. A trading journal is only worth keeping if it really tells you what to change and how to change it.

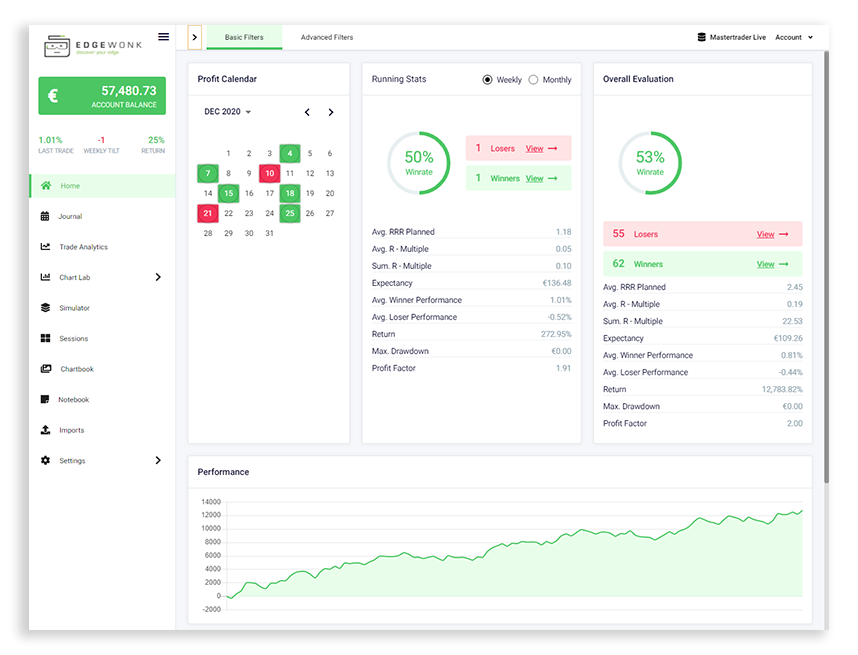

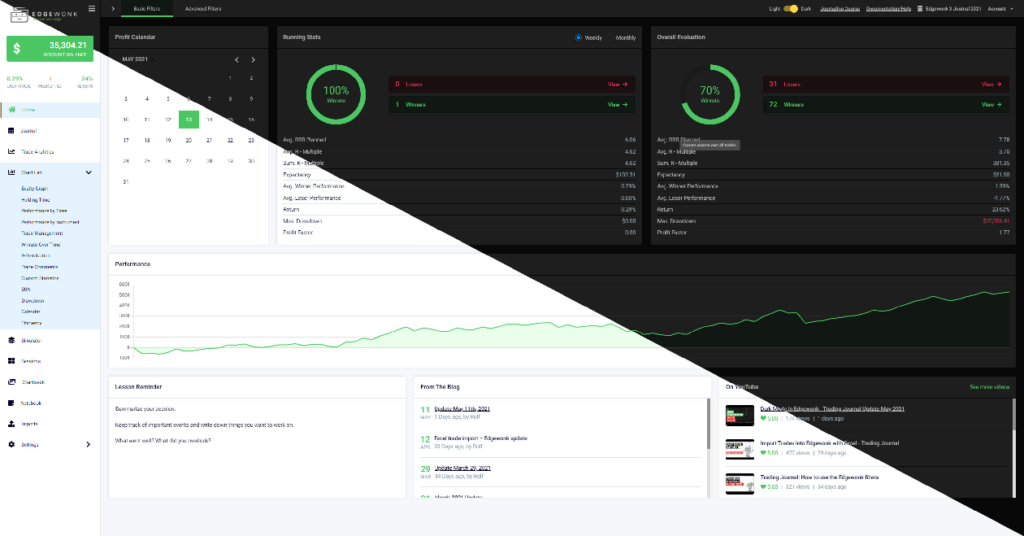

Thus far, only bank traders and big prop trading firms had access to professional trading analytics software. With Edgewonk, every trader can finally use a customized and professional trading journal to work on his (or her) trading.

Edgewonk discount code: all Tradeciety fans can use the discount code “Tradeciety”

Disclosure: Tradeciety is also behind Edgewonk.com and the trading journal software. Our goal with Tradeciety and Edgewonk is to provide high-quality trading education and we are happy to announce that the Tradeciety team has created the Edgewonk trading journal.

Why Edgewonk?

A trader should not spend his time creating spreadsheets that still don’t really provide help. In the end, you want to be a trader, right? A businessman does not write his accounting software himself, but he focuses his energy and time on his real job. You need to start thinking like a professional and work towards your goals with laser focus and clear priorities.

We aren’t developers ourselves, but we hired some to turn our trading journal needs into a user-friendly tool. We wanted, once and for all, to solve the issues with trading journals and allow other traders to stop worrying about this area of their trading.

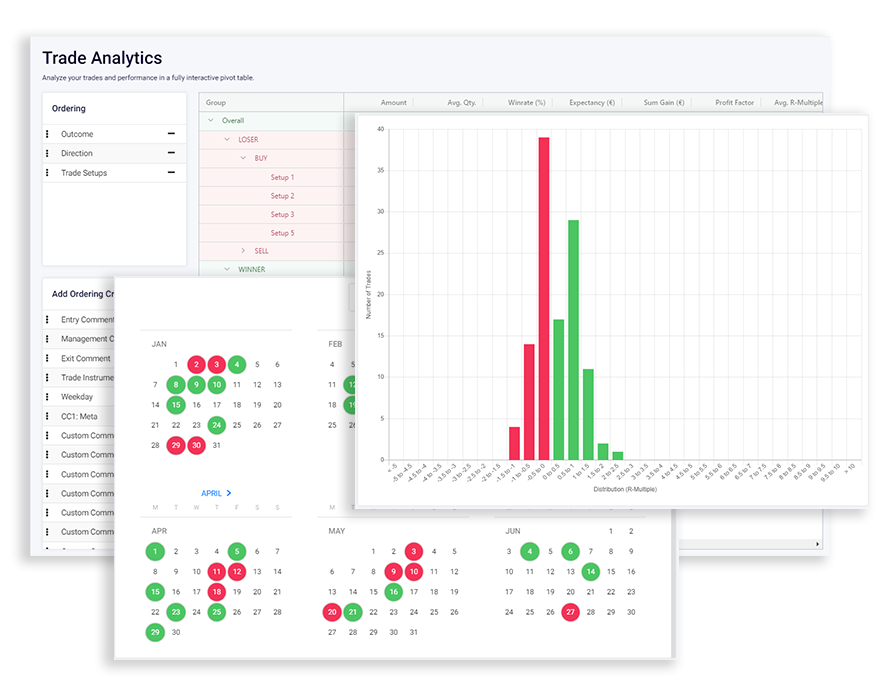

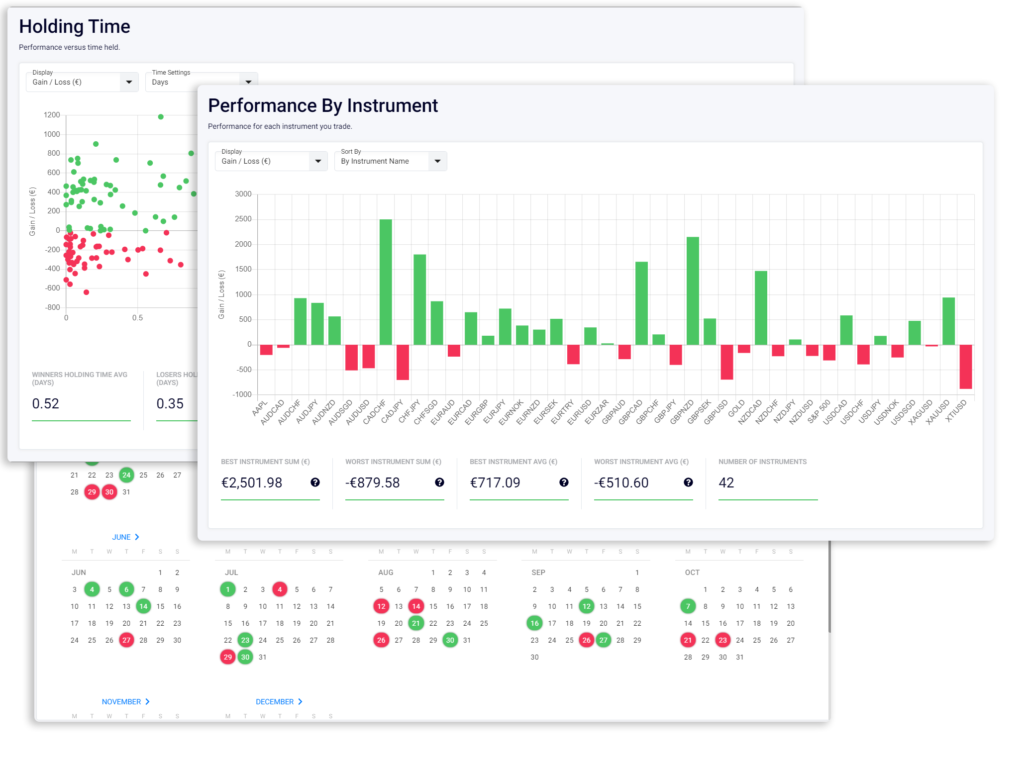

#1 Personalized and fully customizable trading journal

Edgewonk is fully customizable to your own trading style. You can track your own trading strategy, and your individual setups and define personalized trade management and execution comments to create a fully unique journaling experience.

Edgewonk even offers more slots for fully customizable comments/tags. This way, Edgewonk becomes your own personal and professional trading mentor, always ready at hand.

Edgewonk also allows you to enter planned trades, do weekly reviews and even journal missed trades so that you can work on all areas of your trading.

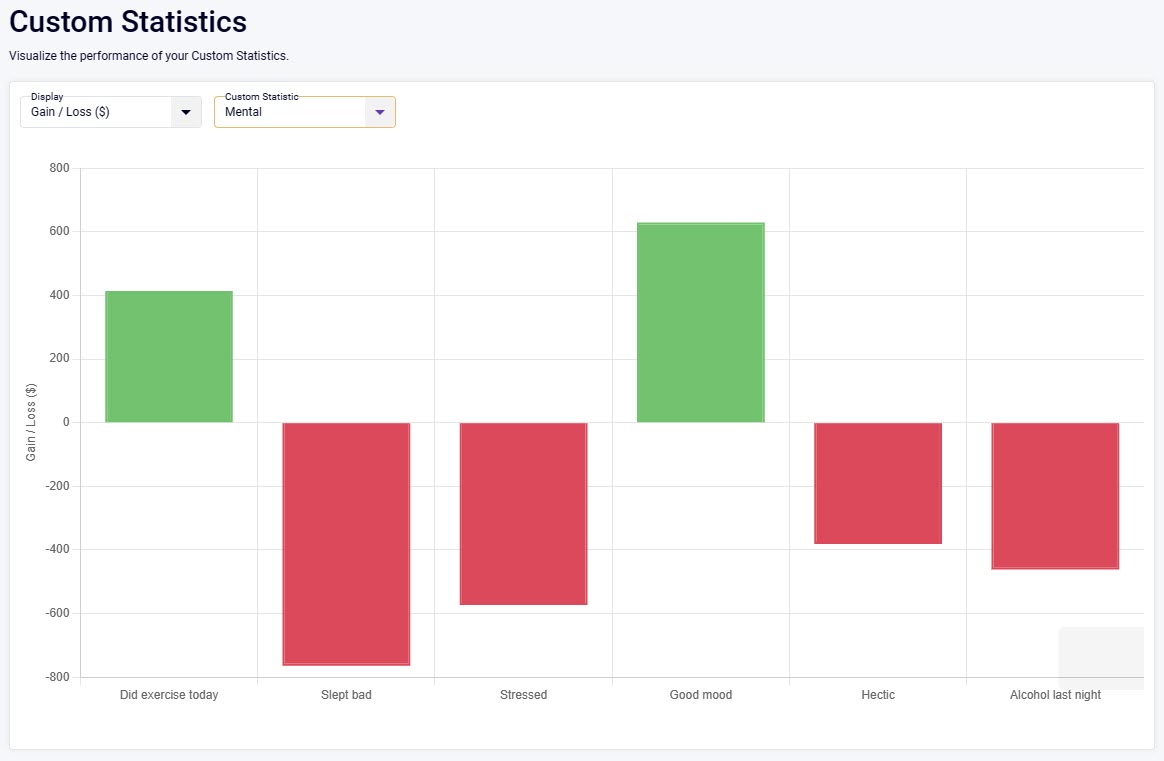

#2 Emotional analytics – Psychology edge

Every trader knows that emotions play a very important role in trading and that emotions significantly influence your trading decisions. Thus far, traders used to manually write down which emotions they think affected them. Edgewonk is the only trading journal that quantifies how emotions impact your trading performance. Furthermore, the built-in Tilt-Meter provides early warning signals when you repeatedly make bad trading decisions. Now you can take out the guesswork and professionally manage your emotions and the psychological aspects of trading.

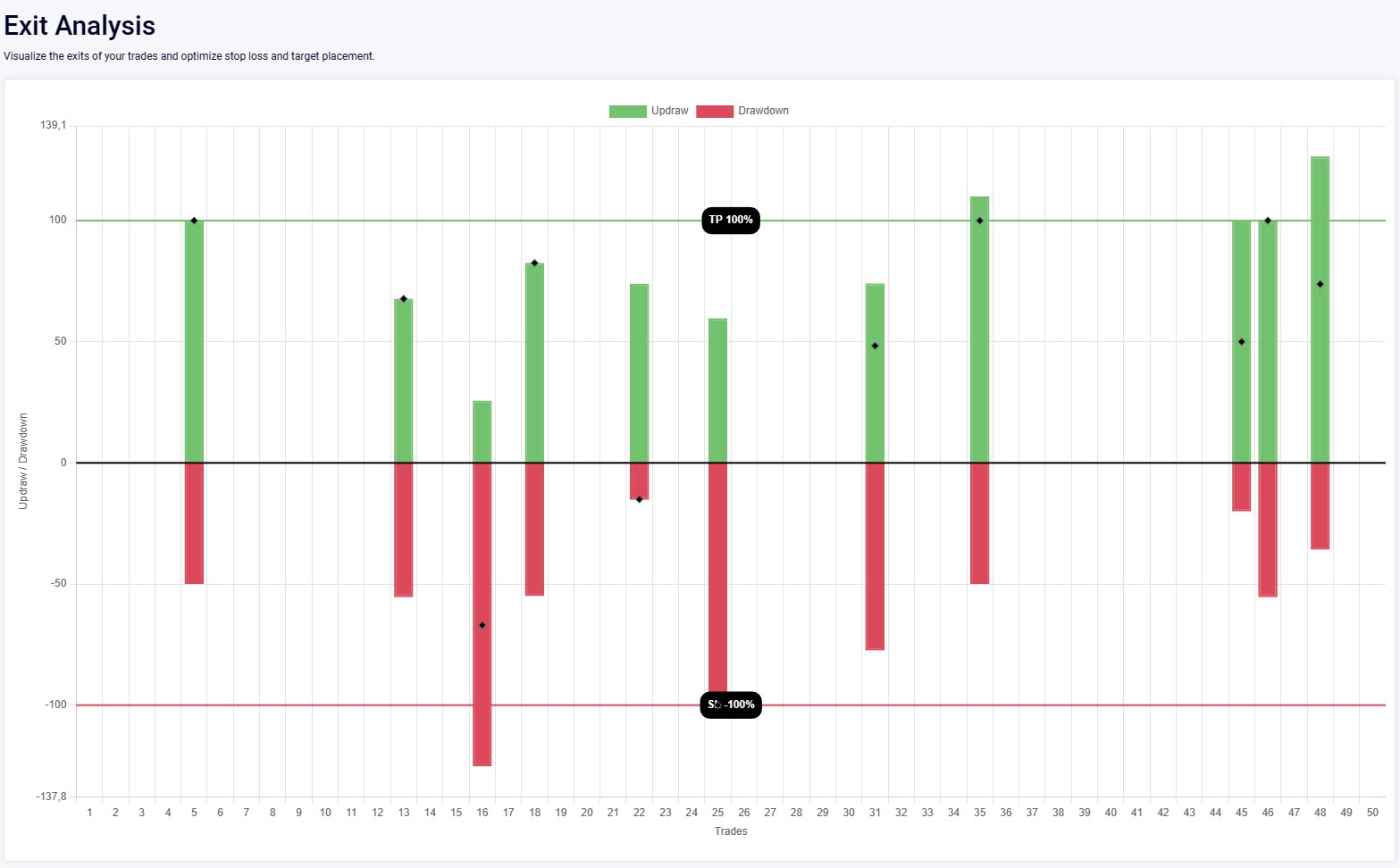

#3 Order Optimization

Edgewonk also helps you optimize your orders and the way you place your trades. For example, setting stop-loss orders too far away reduces your risk-reward ratio and, therefore, the performance of your trading strategy. On the other hand, setting take profit orders too far away will result in a decreased winrate because the price won’t reach your take profit orders and turn around ahead of the target.

Edgewonk takes care of that and provides specific tips, based on your individual trading parameters, to optimize your orders to help you increase your trading performance.

#4 What to do once you are in a trade?

Usually, traders spend all their time focusing on entries and once in a trade, they don’t really know what to do. Edgewonk is aware of this problem and the Trade Management analytics analyze your trading behavior. Micro-management and uncertainty are big problems for traders and the transparent Edgewonk analytics take out the guesswork.

Many top features

Edgewonk has a lot of cool features and every trader will find ways in which edgewonk can help to improve one’s trading. Here is just a brief list of the most popular features:

- Risk Simulator

- Diary

- Track and evaluate emotions

- Daily, weekly, and monthly built-in review feature

- Works for all markets worldwide

- Works for all currencies

- For Forex, futures, stocks, spread betting, and cryptocurrency trading

- Attach up to 6 screenshots per trade

- Analyze your trade management and find the optimal strategy

- Improve stop and target placement

- and much more

Finally, there is a solution to solving the trading journal problem

If you are looking to take your trading to the next level and you are sick of not seeing any results, maybe it’s time to take things a little more seriously and start a professional trading routine.

Get your trading journal at www.edgewonk.com

Use discount code: tradeciety