Trading success is statistically hinged on two factors, win rates and risk-reward ratios. Traders who could find a good mix of win rates and risk-reward ratios are the ones who end up being consistently profitable when trading the forex markets.

Win rates pertain to the win percentages of a trader. This pertains to the percentage of winning trades that a trader obtains out of a number of trades, regardless of the amount of the win. Traders with high win rates tend to win more often than they would lose. Risk-reward ratios on the other hand pertain to the dollar amount that a trader tends to earn on a winning trade compared to the dollar amount being risked on each trade or the average loss on each losing trade.

Having high win rate does not automatically result in a winning strategy, just as high risk-reward ratios also does not result in a winning strategy. Traders should find a good mix between the two. Traders who could trade with win rates above 50% and risk-reward ratios of more than 1:1 tend to be consistently profitable.

One of the ways to improve a trader’s accuracy and yields is by looking for confluences. Confluences provides trend signals which point the same direction at roughly the same time. These conditions are prime for excellent trade setups with high probable yields and high win probabilities.

Heiken Ashi Smoothed

Heiken Ashi Smoothed is a trend following technical indicator which is an offshoot of the Heiken Ashi Candlesticks.

Heiken Ashi literally translates to average bars in Japanese. The Heiken Ashi Candlesticks are just that. They are candlesticks with open and close levels modified to adjust for average price movements. The result are price bars which change color only when the short-term trend has changed.

The Heiken Ashi Smoothed indicator on the other hand also plots bars that change color to indicate trend direction. However, these bars move more similarly to moving averages. Red bars indicate a bearish trend, while lime bars indicate a bullish trend.

The Heiken Ashi Smoothed bars tend to be a reliable trend reversal indicator as it is less susceptible to false trend reversals.

Traders can use the changing of the color of the bars as an indication of a probable trend reversal.

Relative Strength Index

Relative Strength Index (RSI) is a momentum technical indicator which is an oscillator type of indicator.

It plots an RSI line which could oscillate within the range of 0 to 100.

It has a midpoint at 50, which could be used as an indication of trend bias based on the location of the line in relation to it.

It also has markers at level 30 and 70. Mean reversal traders view an RSI line below 30 as an indication of an oversold market, while an RSI line above 70 is interpreted as an indication of an overbought market. Momentum traders view strong breaches beyond this range as an indication of a strong momentum breakout. Both views may be correct at a certain point. It all boils down to the characteristics of price action as the RSI line reaches these points.

Some traders also add levels 45 and 55 to confirm trends. Level 45 acts as a support during a bullish trending market environment, while level 55 acts as a resistance during a bearish trending market.

Octopus Indicator

The Octopus indicator is a custom technical indicator which could be used as a trend direction filter.

This indicator is binary in nature. It only plots bars with the same length. However, the color of the bars changes to indicate the direction of the trend.

Green bars indicate a bullish trend, while red bars indicate a bearish trend.

Traders can use this indicator to filter out trades that go against the current direction of the trend. It could also be used to confirm trend reversal signals based on the changing of the color of the bars.

Trading Strategy

Octopus Heiken Ashi Signal Forex Trading Strategy is a simple trend following strategy which is based on the confluence of the three high probability trend following indicators above.

First, we are to align our trade direction with the direction of the long-term trend. We will be using the 200-perio Exponential Moving Average (EMA) to do this. Long-term trend direction is based on the location of price action in relation to the 200 EMA line, as well as the slope of the 200 EMA line.

Then, confluences between the three indicators are observed.

On the Heiken Ashi Smoothed indicator and the Octopus indicator, signals are based on the changing of the color of the bars.

On the RSI, trend confirmation is based on price breaching above 55 or dropping below 45.

Indicators:

- Heiken_Ashi_Smoothed

- MA Period: 15

- MA Period 2: 6

- 200 EMA

- Octopus_1

- Relative Strength Index

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

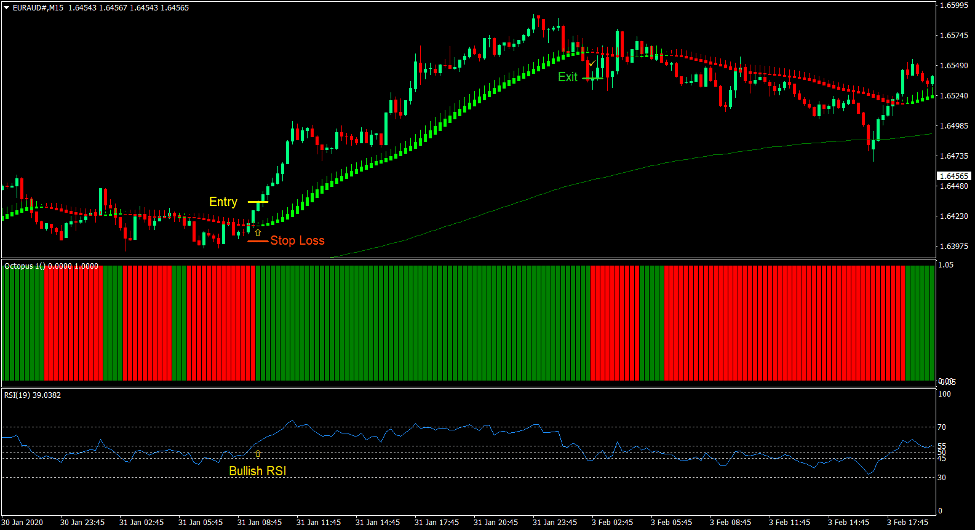

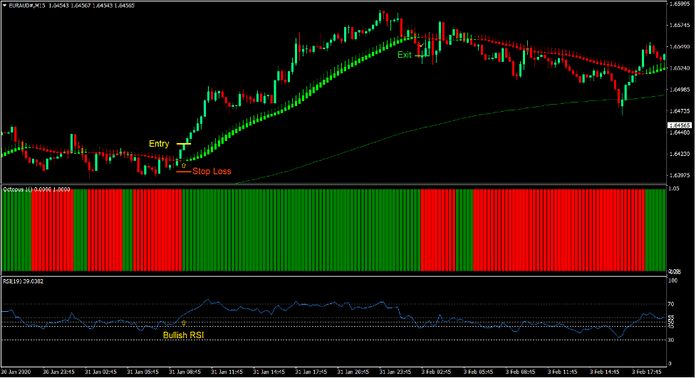

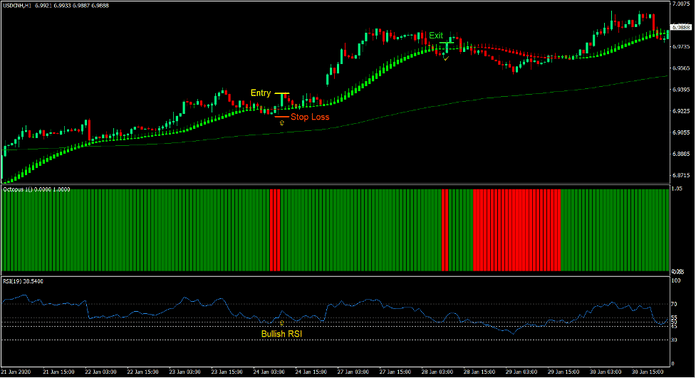

Buy Trade Setup

Entry

- Price action should be above the 200 EMA line.

- The Octopus bars should change to green.

- The Heiken Ashi Smoothed bars should change to lime.

- The RSI line should breach above 55.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on a support below the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi Smoothed bars change to red.

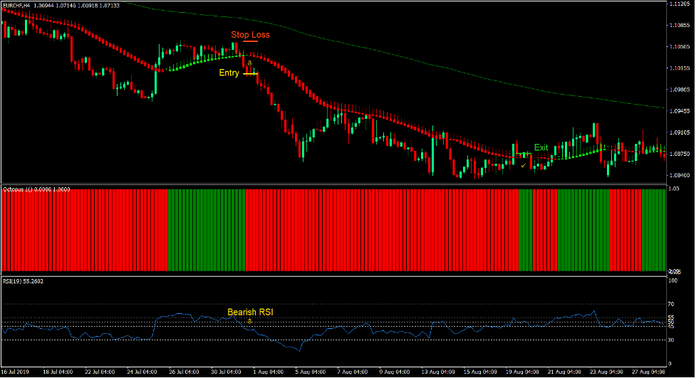

Sell Trade Setup

Entry

- Price action should be below the 200 EMA line.

- The Octopus bars should change to red.

- The Heiken Ashi Smoothed bars should change to red.

- The RSI line should drop below 45.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on a resistance above the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi Smoothed bars change to lime.

Conclusion

The Heiken Ashi Smoothed indicator is a highly reliable trend following indicator. Traders could rely on the trend reversal signals it produces. However, not all trend reversal signals would work out fine. This is why signals should be aligned with a long-term trend so as to increase the probability of a trade setup.

Adding confluences with the RSI and the Octopus indicator significantly increases the chances of a win. The resulting trade setups should be high probability setup with a decent potential yield.

When used in the correct market environment, which is a long-term trending market, this strategy should do wonders.

Forex Trading Strategies Installation Instructions

Octopus Heiken Ashi Signal Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Octopus Heiken Ashi Signal Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Octopus Heiken Ashi Signal Forex Trading Strategy?

- Download Octopus Heiken Ashi Signal Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Octopus Heiken Ashi Signal Forex Trading Strategy

- You will see Octopus Heiken Ashi Signal Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download: