One thing’s for sure – a crypto bull market is a lot more fun and exciting than a bearish period. Well, at least for an inexperienced trader. But any trader with decent mileage knows that to really appreciate the bull run, you need to deploy proper crypto bear market strategies. So, don’t be like most folks who FOMO into the crypto market once the bull run is in its full swing. Instead, use the tranquillity of the bear market to sow the right seeds. Then, you’ll be ready to reap the most significant rewards when the bulls take over!

One of the best and simplest crypto bear market strategies revolves around altcoins!

A traditional altcoin season indicator trio focuses on altcoins rallying as a whole, which is a rather rare occurrence. Plus, it’s typically reserved for bull runs.

However, you’d be surprised to learn that many altcoins go on impressive individual rallies. And, that happens throughout the crypto cycle. So, the key is to spot these opportunities before they pump!

In the past, that was very tricky to do. But now, thanks to Moralis Money, any casual trader can find these types of gems. After all, it’s as simple as running an on-chain query.

Does that sound too good to be true? Well, use the above interactive widget and experience the power of Moralis Money firsthand. Simply select one of the preset filters or apply your unique combination of search parameters. Then, explore the dynamic list of tokens to spot the best altcoin opportunities.

Feel free to take it from here and master making the most out of Motalis Money on your own. However, if you’d like to learn more about other crypto bear market strategies and to get better acquainted with Moralis Money, dive into the following sections.

The Best Crypto Bear Market Strategies to Make Profits

We’ve already pointed out one of the best crypto bear market strategies in the intro. However, let’s repeat it here along with two other potentially highly-profitable tactics. Why “potentially”? Well, may it be a bull market or a bear market, profits are never guaranteed. After all, it all depends on your timing!

Here are the three best crypto bear market strategies:

- Spotting individual altcoin opportunities before they pump.

- Finding crypto gems in their early or highly undervalued phase.

- Shorting the crypto markets.

All of the above three methods can be extremely profitable, especially if you can get your timing right. And, luckily, you can do that by looking at the on-chain data.

You see, on-chain momentum precedes price action. So, by spotting which tokens are gaining or losing on-chain traction, you can frontrun price moves. And, that’s applicable to all of the above-listed strategies.

Strategy #1: Spotting Individual Altcoin Opportunities

As pointed out in the intro, there are many altcoins that tend to pump even during the bear market. Of course, these pumps can be short-lived or they can go on for quite a while and stabilize at much higher levels. And, as you can imagine, there are many factors that determine that. It depends on the project’s quality, fundamentals, “pumpamentals”, and Bitcoin’s movement.

These sorts of pumps in the bear market are particularly common when Bitcoin bounces after a larger retrace or when it goes sideways for a while.

As such, it’s important to rely on real-time on-chain data to see if the token is gaining or losing momentum. Then, you can take the right action.

And, by using this strategy, many Moralis Money Pro users have been pocketing quite impressive gains.

Aside from the tokens mentioned in the above testimonials, many Moralis Money users also made the most of the 2023 memecoin season. With Moralis Money, they detected tokens like WOJAK, TURBO, PEPE, and many others before their initial pumps. So, we are talking about massive gains.

For instance, just look at the PEPE token’s chart. And, keep in mind that by relying on on-chain momentum, users were able to trade multiple ups and downs along the way. However, even those who decided to HODL and entered after the initial rally, are still up more than 600%:

Would you like to be among the people in the know? Visit Moralis Money and lock in your Pro plan today!

Strategy #2: Finding Crypto Gems in Their Early or Highly Undervalued Phase

The second strategy is in many ways very similar to the first one. However, it requires additional in-depth research. Plus, a more detailed consideration of the market conditions as a whole, particularly of the Bitcoin price action is in order.

After all, if you want to enter a token very early or when it’s highly undervalued and hold it until the top of the bull run, you need a very strong conviction. Of course, if you have the skills to combine the power of on-chain data and technical analysis (TA), you can again ride the major swings along the way.

However, just by spotting altcoin gems during the lows of a bear market and exiting near the top of the market, you can make life-changing gains. It’s worth pointing out that the average altcoin tends to offer 50x-70x rallies.

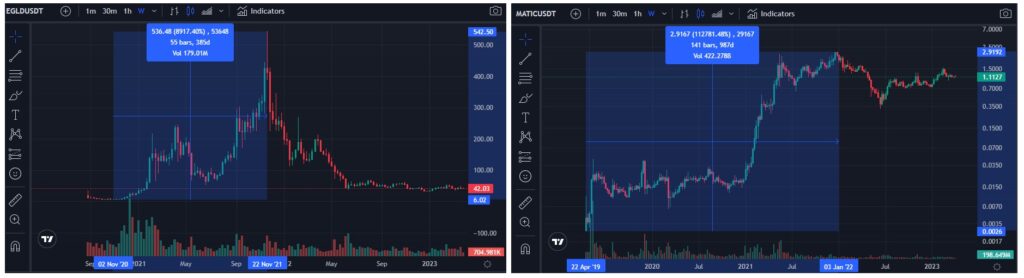

This is the tactic we used in the past crypto cycle when we spotted coins like EGLD and MATIC. The former gave us a chance to ride a 90x rally and the latter a 1000x-plus one.

However, if you take another look at the above two charts, you can see that following all-time highs, the prices started following back down. Well, that’s what happens during the bear market. And, that brings us to the third of the best crypto bear market strategies – shorting.

Strategy #3: Shorting the Crypto Markets

Unlike the above two methods that you can perform on decentralized exchanges (DEXs) by buying, selling, rebuying, etc., you need a “contract for difference” (CFD) trading account to be able to short the markets. This means that you need to have an account on any of the centralized exchanges (CEXs).

Also, you need to make sure that the CEX you plan on using supports the token that you are interested in shorting.

This crypto bear market strategy can be extremely lucrative. After all, the bear market typically brings the princess down to the pre-bull-run levels. However, unlike holding a bag of tokens, when shorting you don’t actually buy the asset. Essentially, you bet that the price of the cryptocurrency in question will go down. As such, your wrong “bets” can leave you empty-handed.

That is why shorting is considered an advanced trading tactic. It definitely calls for proper TA skills and an understanding of perpetual futures trading.

However, with Moralis Money in your corner, you can significantly improve your chances by using decreasing on-chain momentum as crypto signals.

So, whichever of the best three crypto bear market strategies you use, you simply cannot afford to miss out on the insights that the Moralis Money Pro plan provides.

Use the “Moralis Money 101” section below to help you get started with this amazing trading tool. Then, you’ll be ready to spot bullish crypto and bearish crypto trends.

But first, don’t forget to check out three awesome bonus crypto bear market strategies.

Bonus Crypto Bear Market Strategies

Unless you plan on trading cryptocurrencies on shorter timeframes (day trading, scalping) during a bear market, you will typically have more time on your hands than you would during the bull season. As such, you ought to explore other crypto bear market strategies.

One tactic that you should deploy is to dive deeper into learning. Devote some time to master some aspects of the crypto sphere. Or, if you are a beginner, make sure you learn the basics properly. Moralis Academy is a great place for that.

Lower volatility during the bear market is also the best time for BUIDLing. Do you have some programming skills? If so, you can perhaps utilize those skills to build something awesome. You can join one of the existing times or take on your unique projects.

The final bonus tactic that we want to point out is research. Use the bear market to do proper research on the projects that seem interesting to you. After all, even when you detect great opportunities with Moralis Money, you should always DYOR before entering a trade. As such, practicing your crypto research skills is definitely a great investment!

Moralis Money 101

Let’s start this section by looking at the core advantage of Moralis Money. They are as follows:

- Insights into the on-chain activity, which precedes price action

- No confusing on-chain data charts that cause information overload

- Fast and simple access to easy-to-interpret, actionable results

- Generating dynamic lists of crypto tokens that are gaining or losing on-chain momentum with just a few clicks

- Spotting opportunities in all market conditions

- Overcoming FOMO, scams, and time scarcity

Moralis Money Core Features

The following three Moralis Money features are your ticket to marketing the most of any bear or bull market:

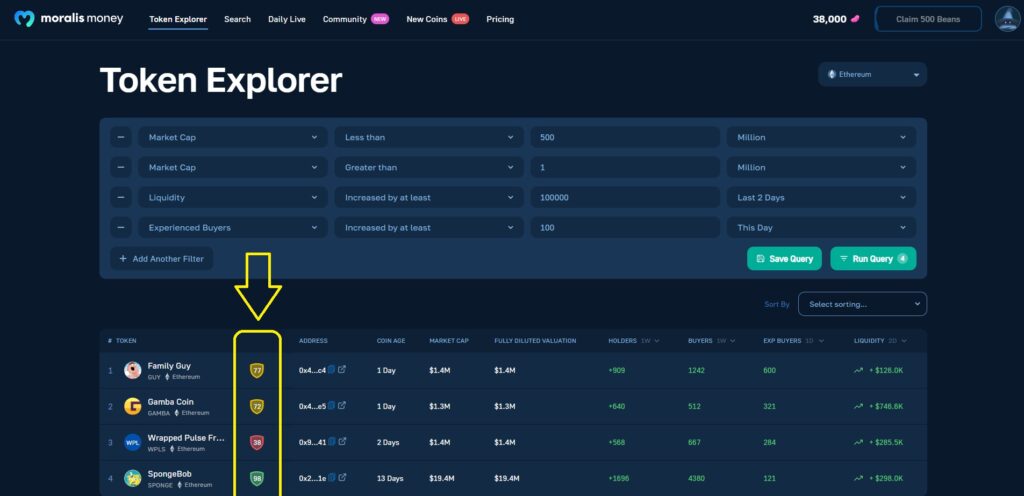

- Token Explorer – This core Moralis Money feature is your ticket to spotting the most unique opportunities that any bear or bull market has to offer. It will help you detect momentum change for new and existing projects and thus beat the price action. This feature allows you to position yourself properly early and thus never FOMO into any trade again.

- Token Shield – It’s time to protect yourself from crypto scams. And, with Token Shiled, you get to stay on the safe side by relying on security scores. You can find these scores inside shield icons for every token on your list of dynamic tokens. The higher the score, the lower the risk of the project’s smart contract having scammy attributes. Moreover, the scores come in color-coded shields to help you instantly spot potentially riskier tokens.

Moralis Money performs security checks automatically whenever you run a query. In addition, you can focus on specific ranges of scores by applying the Security Score filter.

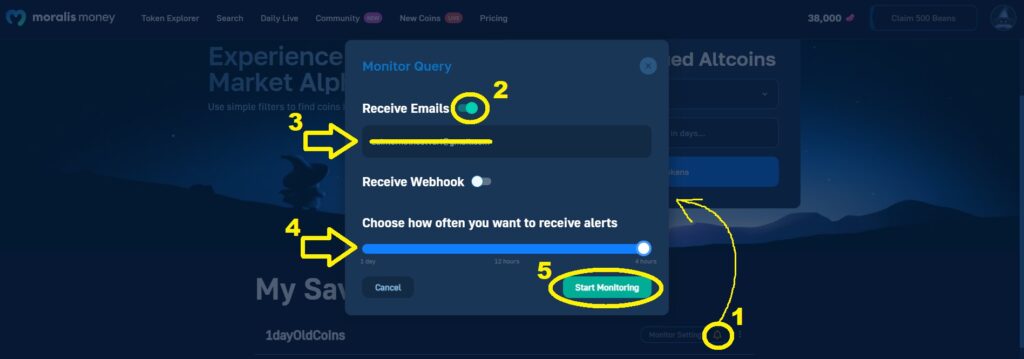

- Token Alerts – With this feature, you get to set bridge the gap of time scarcity. Token Alerts allows you to activate email notifications for your saved queries. This way, you get to run your search parameters on autopilot. As such, Moralis Money detects new opportunities as they appear without any additional time investment on your end. So, whenever you find a combination of filters that works for you, save your query. Then, set up email notifications with a simple five-click process.

How to Start Implementing Crypto Bear Market Strategies

If you are not sure whether we are currently in a bull or a bear market, make sure to check out our crypto trading for dummies guide. However, the steps to use Moralis Money in any market conditions are very similar.

For a single-click start, you can use Moralis Money preset filters. The latter option awaits you on the tool’s homepage:

But as you can imagine, the preset filters aren’t the most unique approach. After all, they are available to all Moralis Money users. As such, you should get comfortable with running your unique queries.

Fortunately, it is as easy as pie to apply your unique combination of search parameters. There are many easy to do that; however, to help you get going, you can follow this three-step guide:

- Access the Token Explorer page.

- Use the Coin Age metric if you prefer to spot newly-minted coins before they pump. On the other hand, in case you prefer to spot an increasing or decreasing momentum in more seasoned coins, apply the Market Cap metric.

- Hit “Add Another Filter” and apply other metrics that will help you determine which cryptocurrencies are gaining/losing momentum. Options like Holders, Buyers, Experienced Buyers, and Liquidity are great for that purpose.

Whichever metric you apply, don’t be afraid to experiment with its values and timeframes. The goal is to find a combination that suits your style and the current market conditions. But do not overthink it – just run your query, tweak the metrics, and rerun. It’s all about mixing and matching until you find your winners.

Finally, make sure to DYOR your potential winners before taking your trades. This is where you should use any tools that will give you the confidence you need. Though a great place to start are Moralis Money token pages.

Crypto Bear Market Strategies – How to Thrive in a Bear Market – Summary

In today’s article, we covered quite some ground. You now know what are the three best crypto bear market strategies. And, you’ve found out that whether you choose to focus on local pumps, crypto gem hunting, or shorting the crypto markets, you can get the edge you need by timing your trades based on real-time on-chain data. But to do this, you don’t have to overwhelm yourself with complicated on-chain charts. Instead, you can get clear and actionable signals from Moralis Money.

And, if you are serious about your crypto trading, you ought to opt in for the Moralis Money Pro account. The latter is your ticket to lower timeframes and will allow you to enter trades before it’s too late.

Remember: On-chain data is the king – it precedes price action. So, start using this unparalleled advantage today! It works in all market conditions!