I recently watched a documentary about Bill Gates on Netflix and the thing that stuck with me the most from it was that he didn’t become one of the wealthiest people in the world through luck or inheriting huge sums of money. He literally reads like 8 books while traveling, he can read 150 pages an hour, and he ENJOYS learning. One of his close friends said “Bill always knows more about any subject than the person he’s talking to about it”. What does this have to do with trading? Everything…

I recently watched a documentary about Bill Gates on Netflix and the thing that stuck with me the most from it was that he didn’t become one of the wealthiest people in the world through luck or inheriting huge sums of money. He literally reads like 8 books while traveling, he can read 150 pages an hour, and he ENJOYS learning. One of his close friends said “Bill always knows more about any subject than the person he’s talking to about it”. What does this have to do with trading? Everything…

The key to trading success is developing yourself into a profitable trader by learning to trade properly and being consistently disciplined to follow an effective trading routine until it becomes a habit.

Here’s what you need to know about trading routines: Trading routines are the real key to success in the market. There’s no magic indicator or algorithmic trading robot that is going to easily make you a profitable trader. Just like Bill Gate’s routine each and everyday over the course of years, led him to insane financial success, so can your trading routine. However, if you have no routine or the wrong routine, you will never become a successful trader. Could Bill Gates have laid around watching T.V. eating Cheetos all day instead of reading everything he could get his hands on about business and programming? Sure. And you would never know who Bill Gates was if he had done that.

There’s a “fire” inside of Bill Gates; a desire to learn, to grow, to be more, that seemed to be part innate and part developed through his childhood. I cannot provide this for you, you must develop it if you don’t have it. But, I CAN give you the framework, the “keys” to the “kingdom” so to speak, but you have to be in the proper trading mindset to be able to ‘turn’ the key. So, if you’re ready, read on and learn about the daily trading routine that has worked for me for the last 10+ years in the market….

The Main Ingredients of My Daily Trading Routine

- My trading routine involves interacting with the market FAR less than many other traders. This works for me and I firmly believe that it will work for you for the following reasons: Less stress, Less time to mess up your trades by over-involvement, low trade frequency, instills discipline, you control only yourself and don’t try to control the market.

- My overall approach is to focus on end-of-day data, which means I focus on the daily chart time frames and I will typically wait until the market closes each day to really sit down and take a close look at the markets in my watch list. This is what I call a part time trading routine and not only does it have the advantage of less screen-time (so you can do other things) but the very fact that you’re spending less time in front of the charts actually will improve your trading performance over the long-term.

- I take a weekly view first: I check out the weekly chart time frames, draw in the key levels, get a feel for the near-term and long-term trends and make a note of any obvious / large price action reversal signals.

- Next, we are looking at the daily chart time frame. We are mainly looking for key levels of support and resistance, the current and recent market conditions: Trending or sideways? And last but not least, we are looking at the PRICE ACTION; any signals that may have formed near the key levels? Any signals formed after a pull back to a level? Note: Levels can be horizontal levels of support or resistance or EMA – exponential moving averages or even 50% retrace levels.

- Now, since this is just a blog post, I have to “gloss” over some of the more detailed topics like money management, trading psychology, stop loss placement, etc, but you can follow the links I just provided to learn a bit more and of course these topics are discussed much more thoroughly in my professional trading course.

- What is the GLUE of all of this? Of my entire trading process? Simple. It’s routine – discipline – habit or RDH. Let me explain this to you (it’s critical) – Remember my mention of Bill Gates earlier? Bill Gates probably has better habits than you (or me to be honest), Warren Buffet too. The elite of the world, those men and women who have amassed large fortunes or otherwise succeed at their craft, got to that point through Routines that took Discipline which turned into Habits. The dedication is unreal, but honestly, that is what it takes. Bill Gates doesn’t read so many books because he hates it, he does it because he genuinely loves it! So, you really must love trading and you must love the routine and discipline if you hope to turn them into proper trading habits. Proper trading habits are what bring you wealth in the markets, there is no easy way or short-cut other than TRULY loving the process. And remember, I can show you my process, the one that has worked for me, but it’s up to you to LOVE it, to be passionate enough about the process to make it work!

My Daily Trading Process: Chart Analysis and Trade Execution

The first major chart aspect of my trading routine is taking a “bird’s eye” view of the markets on my watch list. That usually means starting with the weekly chart time frame and giving it a good once-over. I am mainly looking for key levels in the market, major turning points, trends and areas of consolidation to make note of. I always mark the key levels on the weekly chart first, here’s an example:

Next, I will drop down to a daily chart time frame and begin analyzing it in a very similar way. The key levels from the weekly may need to be adjusted a bit on the daily, depending on the price action or you may need to draw in additional levels:

Now, I am analyzing the near-term market conditions to decide which direction is the best to trade in and what nearby levels / areas are the most important to watch. I will often use a moving average here, like the 21 EMA or similar, to help see the near-term trend and momentum. You will also want to learn to identify periods of Higher Highs / Higher Lows and Lower Highs / Lower Lows, which you can learn more about it in my article on how to identify trending markets.

Last, but certainly not least, I am looking for price action signals / potential trades. I am especially looking for “clean and obvious” signals that line-up with levels on the chart, in other words, that have confluence.

- What you saw above in the charts is a brief overview of my weekly / daily chart analysis routine that I do for all the markets in my watchlist. If you don’t have a watch list, you should read my article on creating market watch lists for more.

- Markets go through phases. Study the markets you like the most in your watch lists and you will get to know them, get intimate with them. If you see some or most of them are in bad trading phases, or sideways consolidation that’s choppy, just glance at them and walk away or don’t even check them for a few days. The best trading phases or conditions are trending or when markets are trading in very defined and larger trading ranges.

- I cannot pound this into your head enough: MOST TRADERS LOSE BECAUSE THEY LOOK AT THE CHARTS TOO DAMN MUCH! The market is not meant to be a casino so don’t treat it as one. Don’t get addicted to it! View and treat the market as a way for you to show how planned, skilled and disciplined you can be and you will get rewarded handsomely for doing so.

How I Find a Trade, Set it Up and Execute It

Now, once you have done the above steps, let’s say you spot a potential trade. Here is how I will set it up with the entry, stop loss and profit target placement…

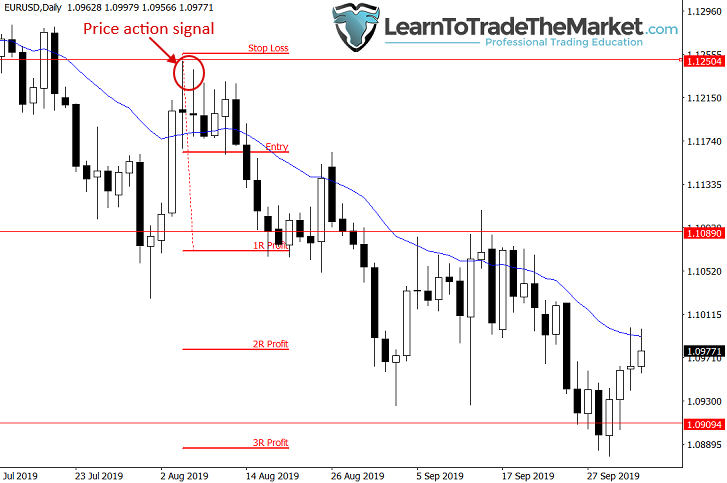

- Notice the “price action signal” in the chart below, this was technically a bearish tailed bar, followed by a pin bar signal that was also an inside bar within that bearish tailed bar. Price consolidated for a few days before ultimately breaking lower with the existing downtrend.

- Price had pulled back to resistance at the 21 EMA (blue line) and the 1.1250 horizontal level, so we had multiple points of confluence: level and trend.

- Traders could have netted 2R profit from this trade had they held on to it for 3-4 weeks after entry. This is why I always preach set and forget trading!

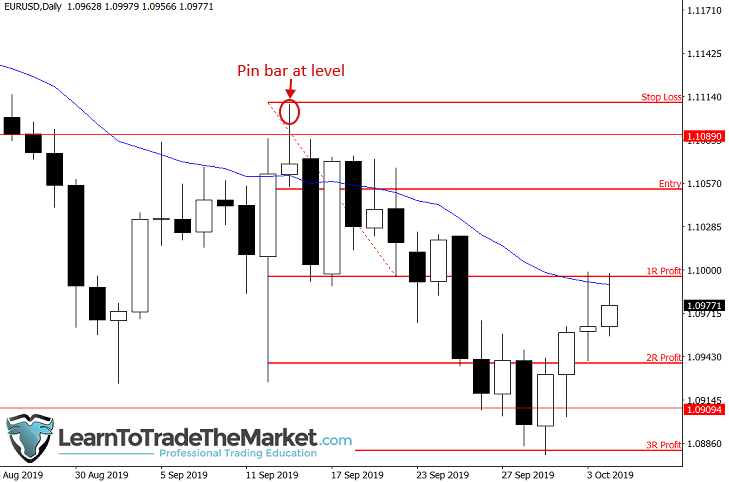

- This example shows a clear pin bar sell signal that formed at resistance (both horizontal and ema) and within a downtrend. This was a very clear and obvious trade for a savvy price action trader. Stop loss was just above the pin bar high and a 2-3R profit was easily achieved if you held the trade for a couple of weeks.

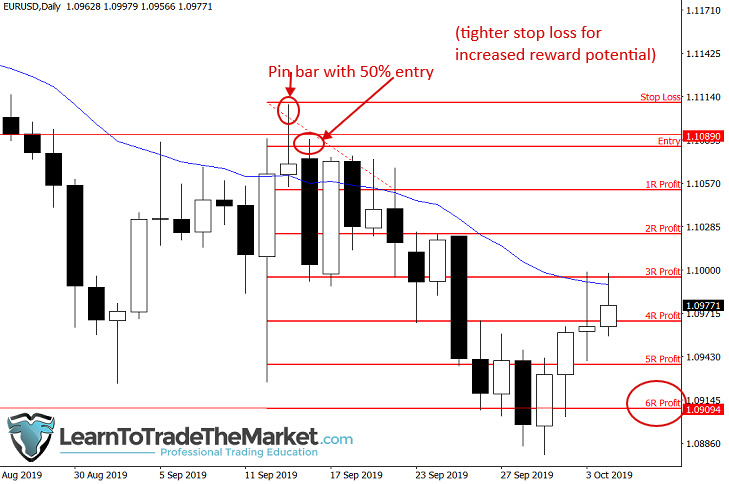

- An interesting “twist” on the last trade above is seen below. Notice the entry was made as a 50% retrace entry of the pin bar’s tail.

- This entry allows for either a tighter stop loss and hence increased potential risk / reward OR with a normal width stop you could give the trade more breathing room. In this case, we are showing a tighter stop with increased risk reward, 6R was possible here!

Conclusion

In today’s lesson, I have shown you how I personally analyze the charts each week and day and gave you a ‘peek’ into my own personal trading habits. Hopefully, after reading today’s lesson (and re-reading it) you now have a better understanding of WHY you need a daily trading routine and HOW to develop one.

The above daily trading routine is the core foundation that all of my trades are built on, and it’s my opinion that all aspiring traders need such a foundation to build their trading career on if they want to have a serious chance at making consistent money in the markets.

Many of you know I publish a daily market commentary each day shortly after the daily Forex market close. However, what you may not know is that doing these daily commentaries (similar to above charts) is also part of my daily chart analysis and trading routine. I actually started writing down my thoughts about the markets each day well before I started this website, and it’s something I’ve done continuously every trading day for about the last decade. It’s literally a habitual part of my daily life…if I miss a day of commentary for some odd reason, like travel or a holiday, I literally feel ‘strange’, and like something is ‘missing’. You need to get to that point too.

For on-going help and assistance with learning to trade, analyzing the markets, spotting trades and building your own personal trading plan, my daily commentary and members’ analysis is a great example of how I perform my rolling (ongoing) analysis of the market in real-time conditions. This is something that you can learn from me and mimic on your charts. I encourage you to “watch over my shoulder” each day as I analyze the charts and plan my trades in the members daily chart analysis area and my trade ideas newsletter.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.