The typical software startup raised their Series A 15 months after raising their seed at 2x their seed valuation.

A year ago, that Series A would have been raised three months earlier at 3.5x the valuation.

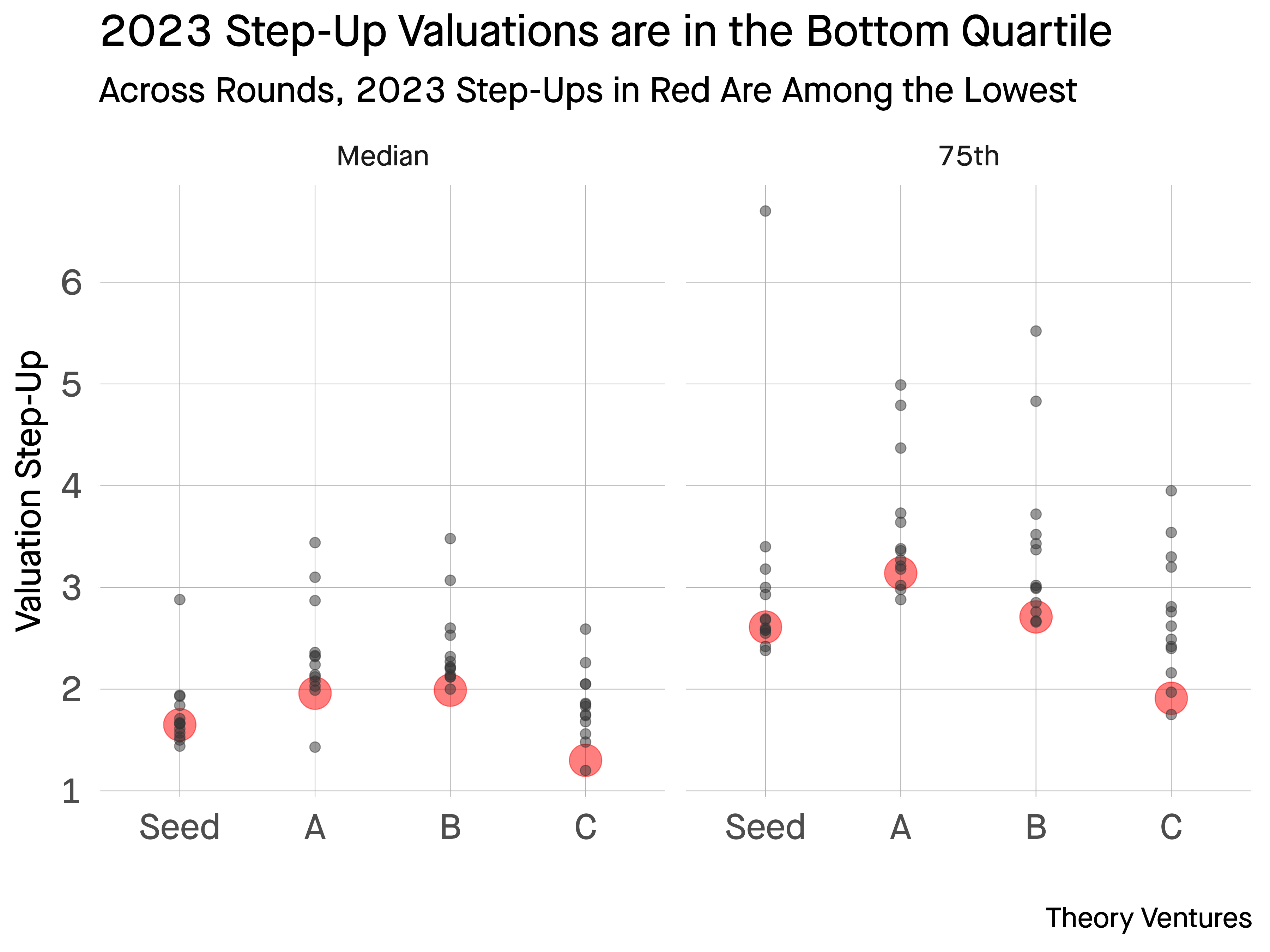

Here’s another way of visualizing the data. The red dot is 2023 – the other years are in grey. Across rounds for the 50th & 75th percentile of companies, step-up valuations are the lowest multiples in about ten years.

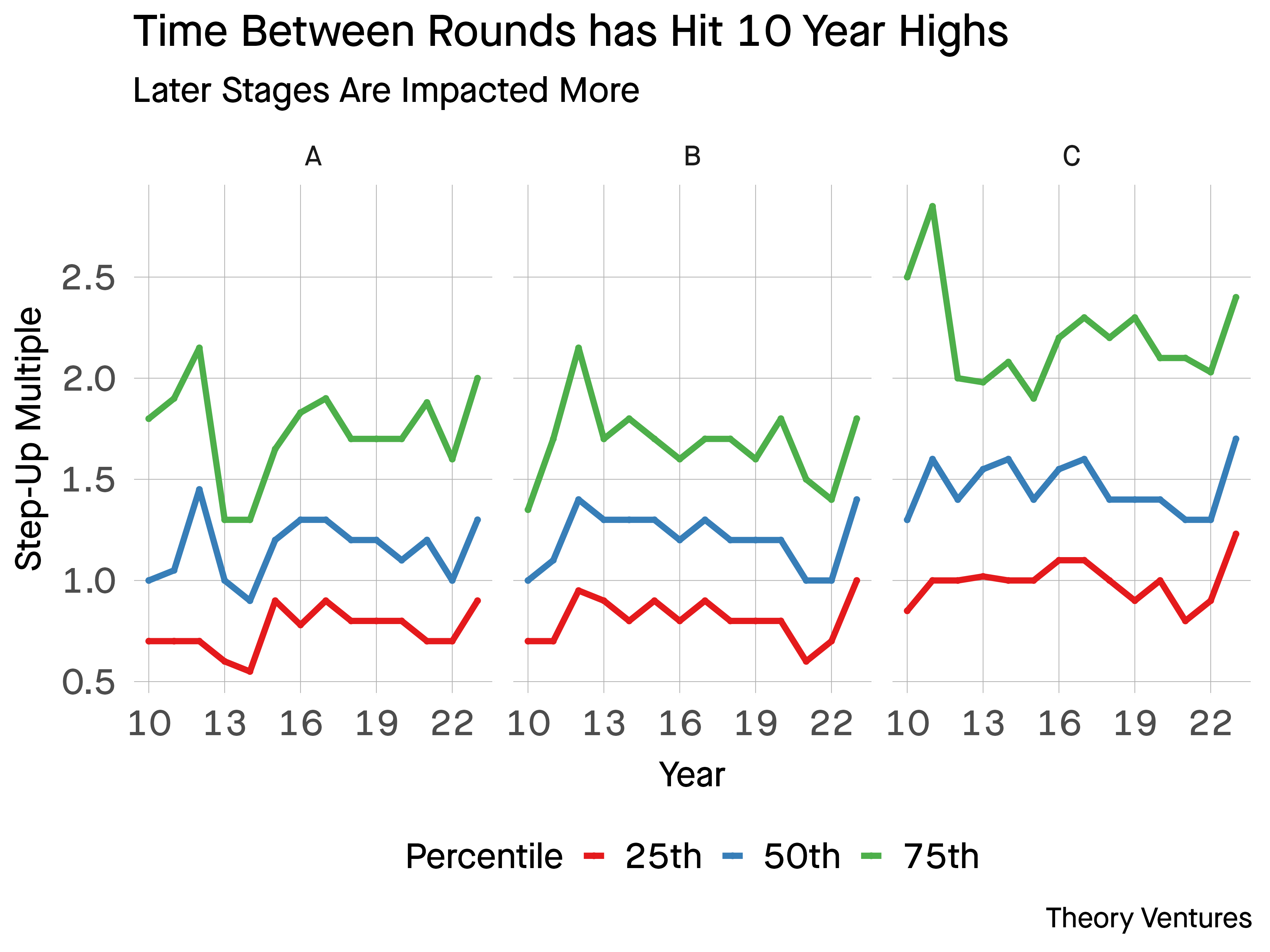

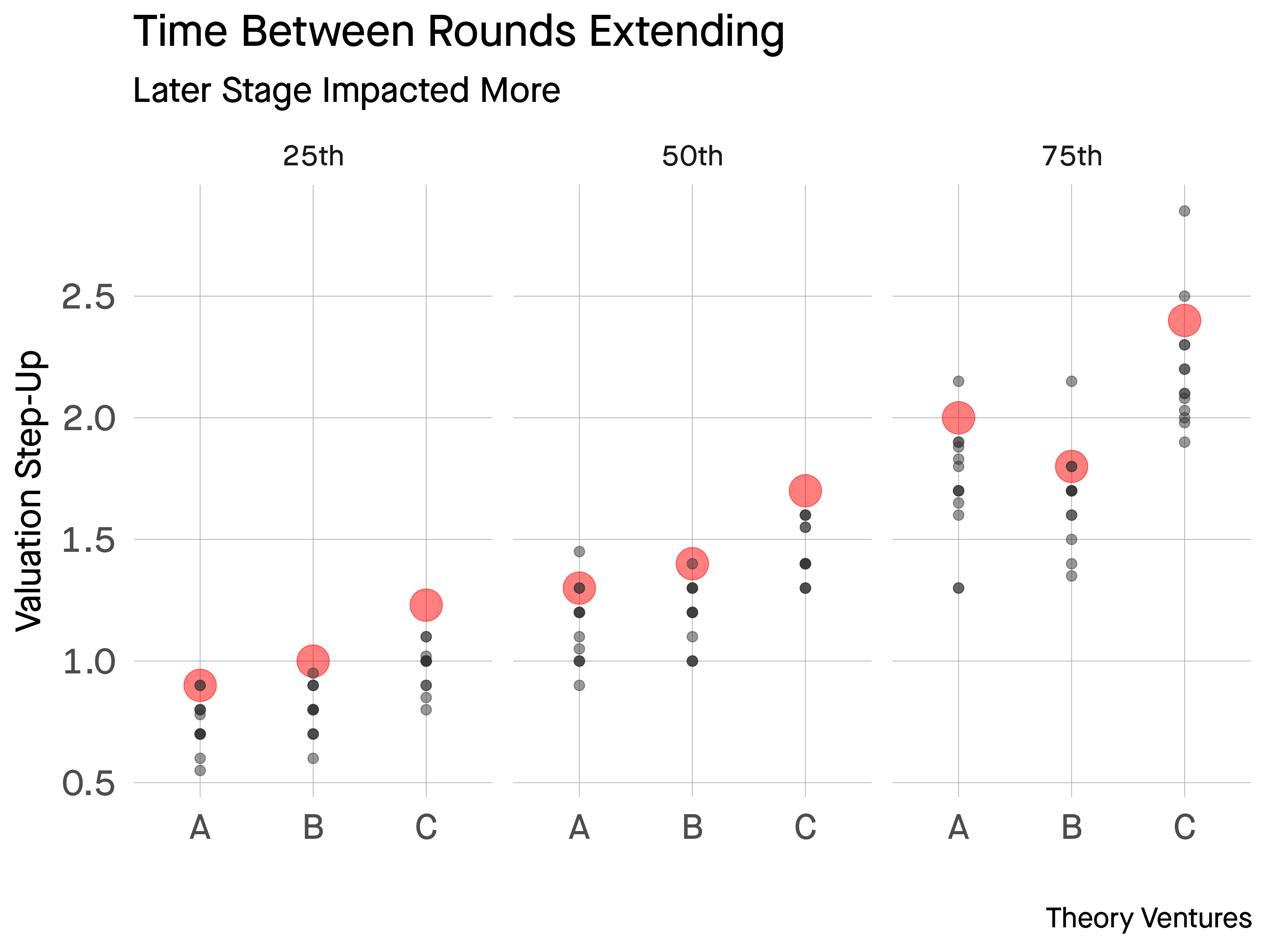

The time between rounds has also lengthened – something all of Startupland felt throughout 2023.

In almost every category, the time between rounds is also at decade highs.

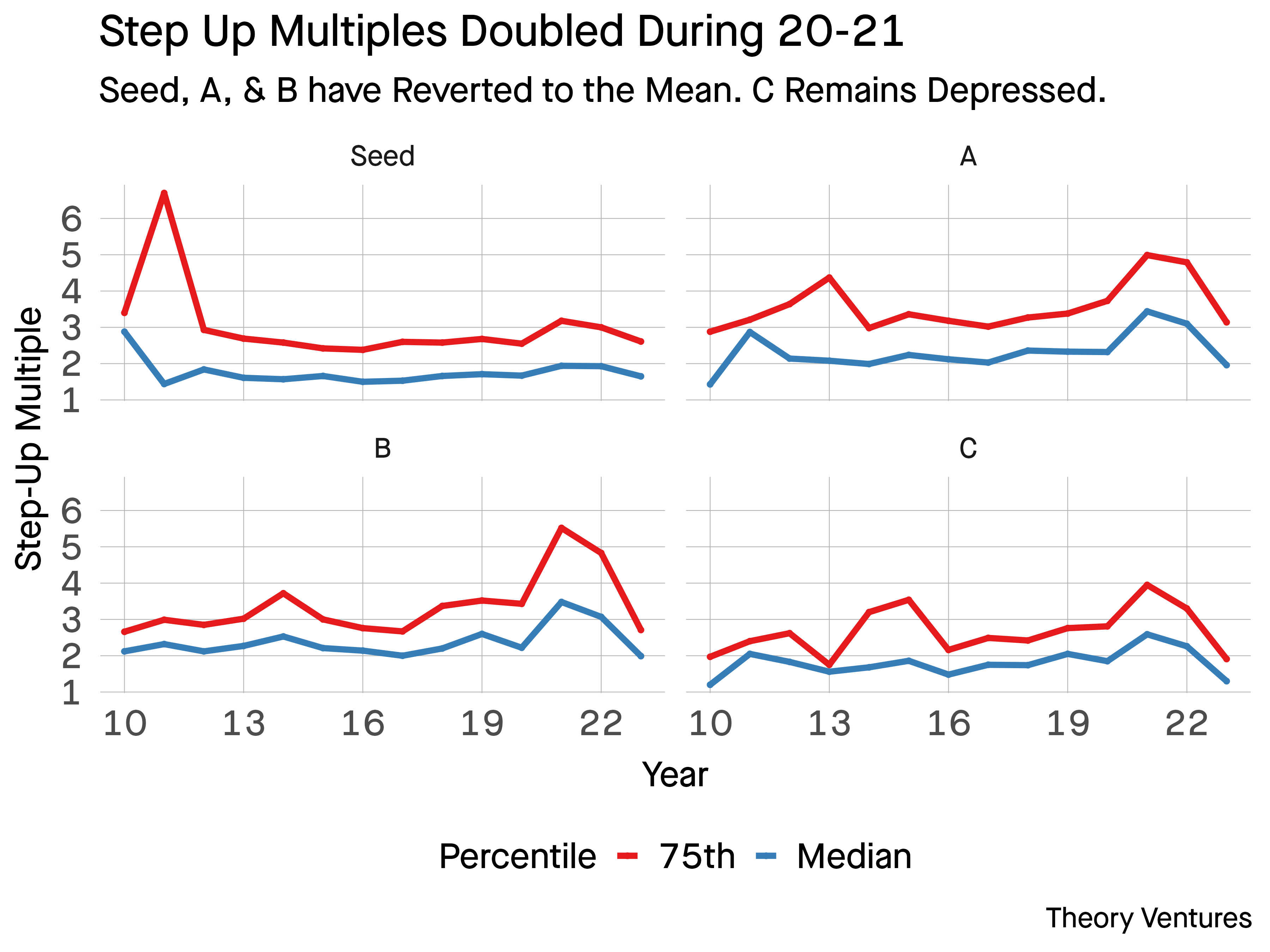

In 2024, I expect most of these figures to revert to the mean – not the peaks of 2020-2021, but more akin to 2018.

The public valuation environment & pace of venture capital investments mirror those years better than others.

Five years ago, valuations continued to grow, competitive rounds didn’t last in market for more than a week or so, & pre-emptions did occur. But most of the market operated at a steady cadence with predictable figures for traction, valuation, & dilution.