Market Overview: NASDAQ 100 Emini Futures

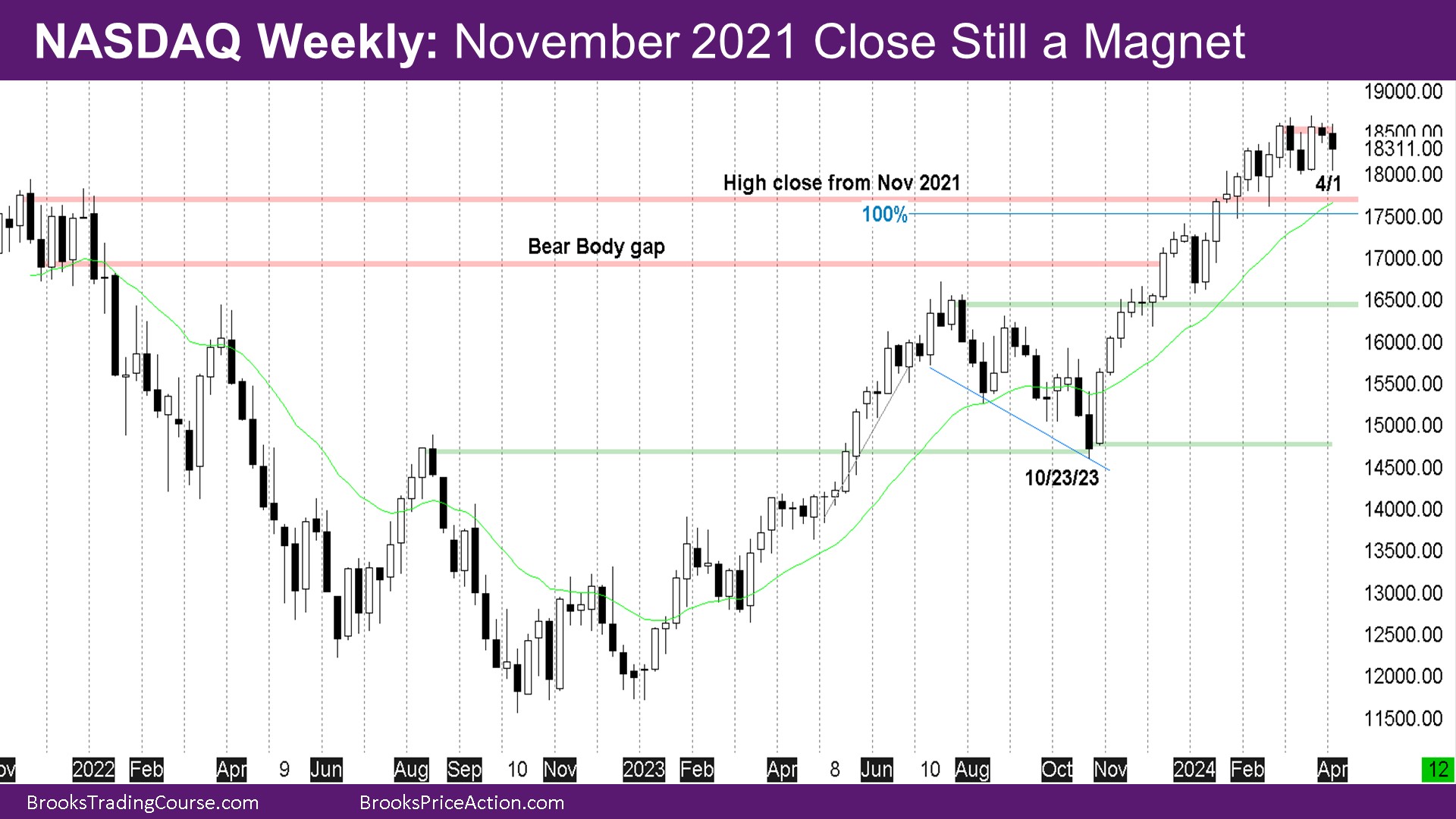

The NASDAQ Emini futures week is a doji bear bar with a longer tail below. The market has been sideways for past 6 weeks since 2-26.

On the daily chart, the market has been unable to close above the high close of March 1 at 18588.75. This will likely lead to lower prices to try and close the November 2021 bull gap.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is a bear doji bar with a longer tail below.

- The last 6 weeks mostly represent sideways move.

- This is another week where the market hasn’t closed above the high close from 5 weeks ago.

- The November 2021 close is still in play as it currently represents an open bull gap.

- The market is likely going sideways till the exponential moving average (EMA) goes above the November 2021 gap, in which case bulls will likely buy if the market gets to the EMA or the November 2021 gap and still be able to keep the gap open.

The Daily NASDAQ chart

- The market continues to make lower high and lower low closes and has been below the high close of March 1.

- The market appears to be in the bear leg of a trading range and wants to test the November 2021 high close.

- Possibly the market will then be in a trading range between the November 2021 close and the high close of March 1.

- Monday was a doji bar.

- Tuesday looked like a bear breakout but ended with a tail below and bad follow-through Wednesday.

- Thursday was another big bear trend bar closing below the EMA.

- Thursday looked like a give-up bar for the bulls that had bought bull closes in March. The high of Thursday reached those closes and then the market sold off.

- Friday was a disappointment for the bears as it was a bull bar, although it closed with a tail above and a close below the EMA.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.