Market Overview: Crude Oil Futures

The weekly chart formed a Crude Oil pullback, closing as a bear doji following last week’s breakout above the bull channel. The bears want a failed breakout above the bull channel and a reversal from a wedge pattern. If the market trades lower (pullback), the bulls want the 20-week EMA or the bull trend line to act as support.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bear doji.

- Last week, we said that the odds slightly favor the market to remain in the bull channel with pullbacks in between.

- The bears see the recent sideways to up pullback as forming a wedge bear flag (Dec 26, Jan 29, Apr 12). They also see an embedded wedge in the third leg up (Jan 3, Mar 19, and Apr 12).

- They want a failed breakout above the bull channel.

- The problem with the bear’s case is that they have not been able to create strong selling pressure with follow-through selling since the pullback started in December.

- They will need to create consecutive bear bars closing near their lows to convince traders that they are back in control.

- The bulls see the selloff to the December 13 low simply as a bear leg within a trading range.

- They got a weak bull channel with overlapping candlesticks trading above the 20-week EMA for weeks.

- The market has further strengthened in the last few weeks with bull bars closing near their highs and breaking above the bull channel.

- If the market trades lower (pullback), the bulls want the 20-week EMA or the bull trend line to act as support.

- Since this week’s candlestick is a bear, it is a neutral signal bar for next week.

- For now, the odds slightly favor the market to remain in the bull channel with pullbacks in between.

- The market is trading near the upper third of the trading range, which is the sell zone of the trading range traders.

- Traders will see if sellers appear around this area, or higher up in the trading range.

- The inability of the bears to create meaningful follow-through selling pressure has increased the odds of the bull leg testing the upper third or the trading range high area.

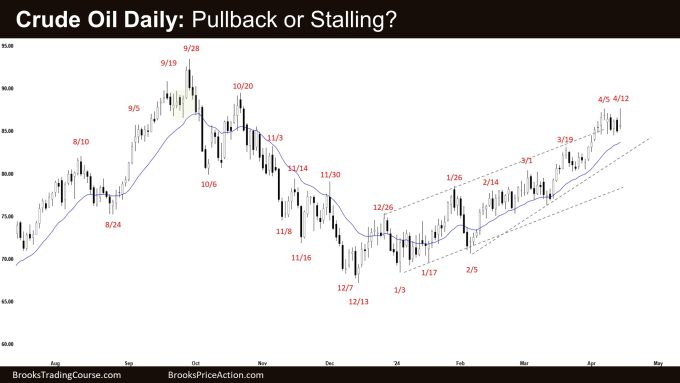

The Daily crude oil chart

- The market opened slightly lower and traded sideways for the week.

- Last week, we said that the move up is strong enough to favor at least a small second leg sideways to up after a pullback.

- The bulls hope that the bull leg to retest the trading range high (Sept 28) is currently underway.

- If the market trades lower (pullback), they want the pullback to be weak and shallow and the 20-day EMA or the bull trend line to act as support.

- They want at least a small second leg sideways to up to retest the prior trend extreme high (Apr 12).

- The bear sees the current pullback as forming a wedge bear flag (Dec 26, Jan 26, and Apr 12). They also see an embedded wedge forming in the third leg up (Mar 1, Mar 19, and Apr 5) and a small double top (Apr 5 and Apr 12).

- They see the move up simply as a bull leg within a trading range and a buy vacuum test of the trading range high area.

- The problem with the bear’s case is that the selling pressure continues to be weak (poor follow-through selling) while the buying pressure is becoming stronger (stronger consecutive bull bars closing near their highs).

- They need to create strong consecutive bear bars trading far below the 20-day EMA and the bear trend line to increase the odds of lower prices.

- For now, the move up is strong enough to favor at least a small second leg sideways to up after a slightly larger pullback.

- The bull leg to retest near the trading range high may be underway.

- The market is also trading near the upper third of the trading range, which can be the sell zone of trading range traders.

- Traders will see if sellers appear aggressively here, and if not, then the next area to watch for is around the September 28 high area,

- The inability of the bears to create meaningful follow-through selling pressure has increased the odds in favor of more sideways to up movements.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.