Market Overview: EURUSD Forex

The bears got a disappointing EURUSD follow-through selling on the weekly chart. They hope that this week was simply a pullback and hope to get at least a small second leg sideways to down. The bulls want a reversal from a higher low major trend reversal, a larger wedge bull flag (Mar 15, Oct 3, and Apr 16) and a wedge in the third leg down (Dec 8, Feb 14, and Apr 16).

EURUSD Forex market

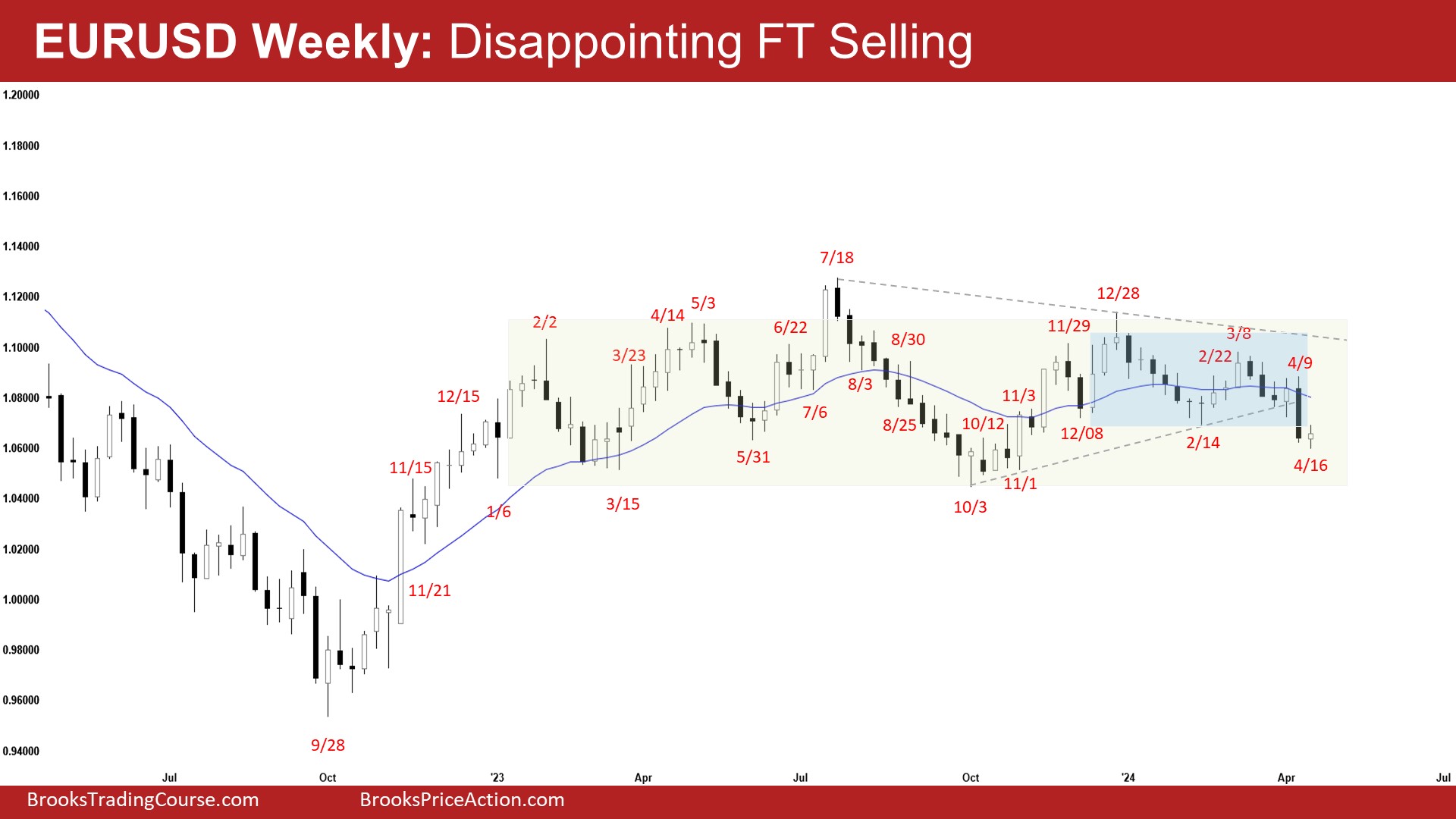

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a small bull doji with tails above and below.

- Last week, we said that the odds slightly favor the market to trade at least a little lower. Traders will see if the bears can create a follow-through bear bar. If they do, it will increase the odds of a retest of the October 2023 low.

- The market traded slightly lower earlier in the week but reversed to close with a small bull body.

- The bears got a breakout below the triangle pattern and the smaller 22-week trading range last week.

- However, they were not able to get a follow-through bear bar this week.

- They hope that this week was simply a pullback and hope to get at least a small second leg sideways to down. They want a retest of the large trading range low (Oct low).

- If the market trades higher, the bears want the market to stall around the breakout point or the 20-week EMA.

- They want another leg down, completing the wedge pattern with the first two legs being February 14 and April 16.

- The bulls see the current move simply as a two-legged pullback (which started on Dec 28) and a bear leg within a trading range.

- They want a reversal from around the lower third of the large trading range.

- They want a reversal from a higher low major trend reversal, a larger wedge bull flag (Mar 15, Oct 3, and Apr 16) and a wedge in the third leg down (Dec 8, Feb 14, and Apr 16).

- Since this week’s candlestick is a small bull doji, it is not a strong signal bar for next week.

- While the bears were not able to create strong follow-through selling, the small bull doji may not be enough to reverse the big bear breakout bar.

- Traders may want to see at least a small micro double bottom before they would be more willing to buy aggressively.

- For now, the market may still be in the sideways to down bear leg.

- Traders will see if the bears can get another leg lower or will the market continue to stall around the current levels (lower third of the large trading range).

- The EURUSD is in a 74-week trading range. (Trading range high: July 2023, Trading range low: Oct 2023).

- The lower third area of the large trading range which could be a buy zone for trading range traders.

- Traders will continue to BLSH (Buy Low, Sell High) within a trading range until there is a breakout with follow-through selling/buying.

- Poor follow-through and reversals are hallmarks of a trading range.

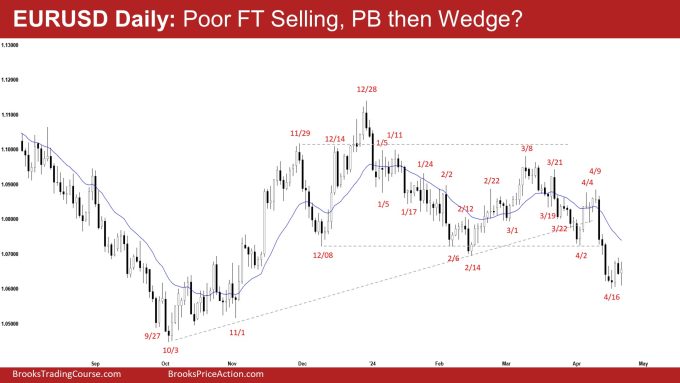

The Daily EURUSD chart

- The EURUSD traded slightly lower earlier in the week but stalled and pulled back a little higher. Friday formed a small retest of the April 16 low closing as a bull doji with a long tail below.

- Last week, we said that odds slightly favor the market to trade at least a little lower and favor at least a small second leg sideways to down after a small pullback.

- The bulls hope that the breakout from the triangle and the smaller trading range will fail.

- They hope that the current move will form a higher low major trend reversal and a wedge bull flag (Dec 8, Feb 14, and Apr 16).

- They want a reversal from around the lower third of the large trading range.

- They will need to create a few strong consecutive bull bars trading back above the 20-day EMA to indicate that they are back in control.

- The bears got a breakout below the smaller trading range and the triangle pattern.

- However, the follow-through selling is not as strong as the bears hope it would be.

- They see this week simply as a pullback and want another strong leg down.

- If the market trades higher, they want the pullback to stall around the 20-day EMA area and form another leg down, completing the wedge pattern with the first two legs being April 2 and April 16.

- For now, traders will see if the bears can create another leg down after the current pullback (bounce).

- The market is currently trading around the lower third of the large trading range which could be the buy zone of trading range traders.

- Traders will continue to BLSH (Buy Low, Sell High) within a trading range until there is a breakout with follow-through selling/buying.

- Poor follow-through and reversals are hallmarks of a trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.