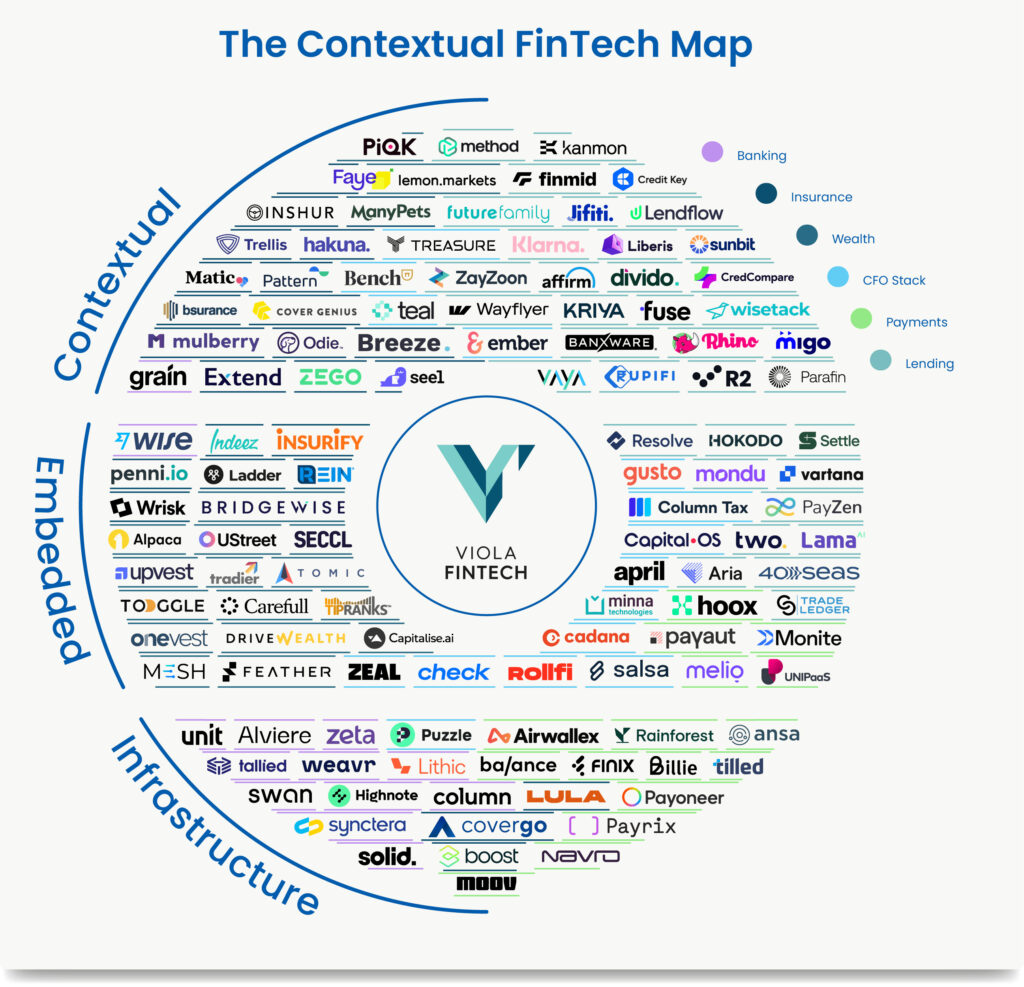

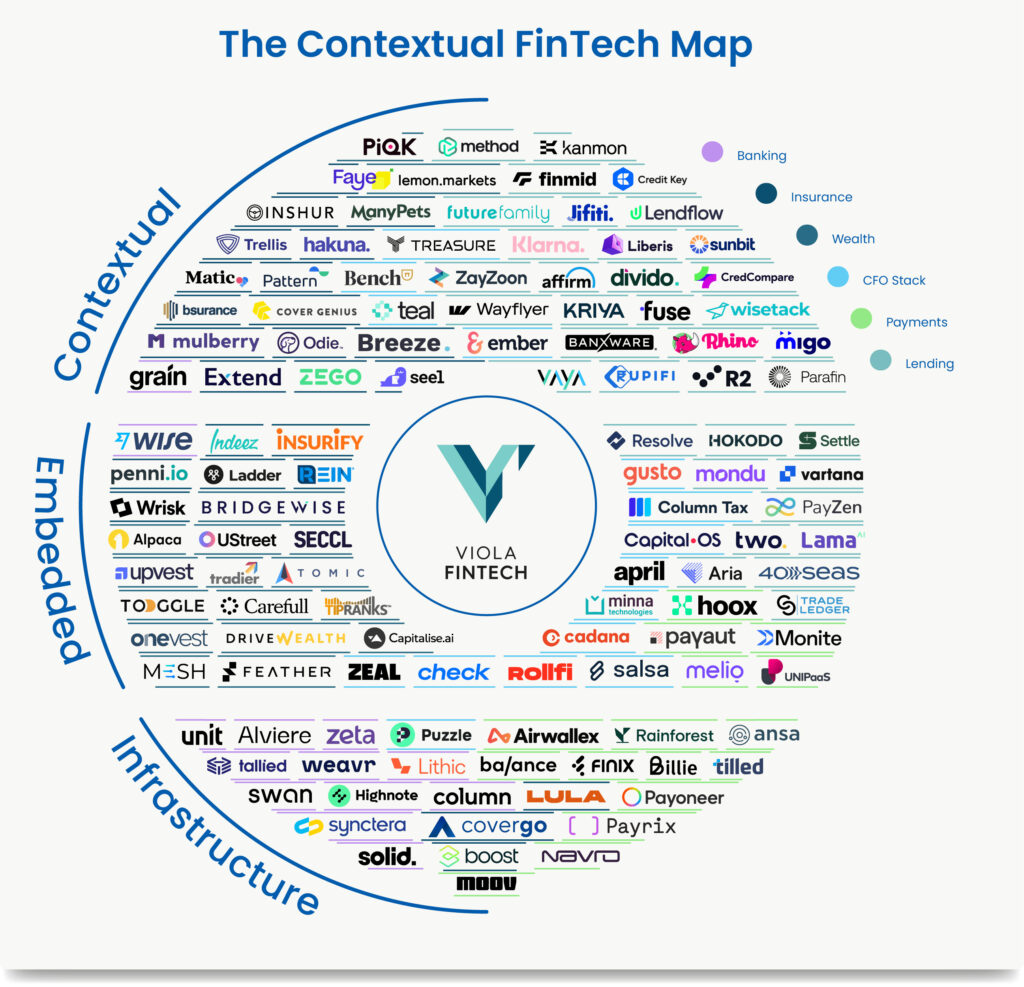

A new report from Viola Fintech shows why companies must go beyond embedded finance to contextual finance if they want their share of a pie estimated to reach $588 billion by 2032. It Depends on the Context: From Embedded to Contextual Finance is available here.

Partner Noam Inbar said the rise of Generative AI and model commoditization make personalization more achievable. The trick is distribution. Crack that nut, and your costs are near zero.

How contextual finance goes beyond embedding

Most embedded finance firms limit themselves because they see distribution as simply embedding one product within another. Inbar said their main fault is they fail to consider the customer’s needs when designing the service. Does this development benefit the customer in any way? Does it provide value?

Often, the answer is no.

“Most of the discussions when VCs talk about embedded finance are about this person getting very low distribution,” Inbar said. ”If you look at the value chain, it’s never about the customer.

“There’s an opportunity to leverage data and understand context so that you can tailor a very accurate user experience. If you do that, you’ll also win by focusing on the customer.”

The key to successful contextual finance

Designing an optimal contextual finance experience begins with understanding intent. Consider the entire customer journey and look to points where you can add value. Inbar said that financial products are often a secondary concern. Folks don’t wake up excited about shopping for mortgage insurance.

But they do dream about buying homes, and mortgage insurance is part of that process. How can you bundle that experience within the contextual home-buying journey? Look to insurance offered inside online travel portals for a good example.

Meeting that need intuitively is critical. Shoppers may have a trusted go-to grocery or clothing brand. That relationship is a foundational piece for an embedded finance offering, but if there is no need to be met by a banking offering, what’s the point?

“When you choose to leverage your distribution power, I think you need to be thoughtful about the types of interactions you want to offer your customers within that,” Inbar said. “We can do this; we can choose the experiences we tailor. It’s about how we adopt the perspective of looking at the customer’s intent and the journey.

“When I think of scale, scale is often addressed from a technology perspective. I think technology’s great; it is constantly maturing and enabling many things that weren’t possible in the past. Still, it doesn’t exempt anyone using the technology from needing to be more thoughtful about leveraging it.”

Top contextual finance use cases

It Depends on the Context: From Embedded to Contextual Finance lists six interesting use cases for contextual finance, beginning with earned wage access (EWA). Inbar sees EWA as part of a larger employer play where it contributes to employee wellness. That positively influences relationship building, intent and employee performance.

Viola Fintech recently invested in ZayZoon, an EWA and financial wellness platform. Inbar said ZayZoon serves as the connective tissue between employers and employees by leveraging data to help the employer better serve and educate the employee as a consumer. Used by companies like Mazda, Doubletree and McDonald’s, ZayZoon also offers perks at stores and restaurants.

“We think there’s a wealth of opportunities in that space because there’s so much data and so many things you can create,” Inbar said.

Insurance is another area. Inshur offers insurance for drivers embedded inside Uber’s app. Financing provides various opportunities, from BNPL to in-purchase financing that drives conversion. Parafin manages activity and payouts within food delivery apps.

The CFO stack, banking and wealth management are other vital areas. Embedding within vertical fintechs like healthcare is a trend to watch.

The challenge in delivering financial literacy

Financial literacy is a much-talked-about topic that is hard to deliver, Inbar said. That education must be delivered within another activity that initially attracts the user. Again, it must have the proper context.

“That’s where I’m consuming because I’m there right now,” Inbar said. “I think that’s super powerful. I haven’t met the company doing that (with financial literacy), but I’m very interested in meeting companies like that. That ties in huge and has a lot of potential.”

Also read: