Polkadot (DOT), the interoperable blockchain platform designed for connecting different blockchains, is currently caught in a tug-of-war between technical indicators suggesting a potential price dip and bullish predictions from some analysts.

Recent price movements paint a somewhat gloomy picture. DOT breached the lower boundary of its ascending trend channel, a technical indicator often interpreted as a sign of weakening momentum.

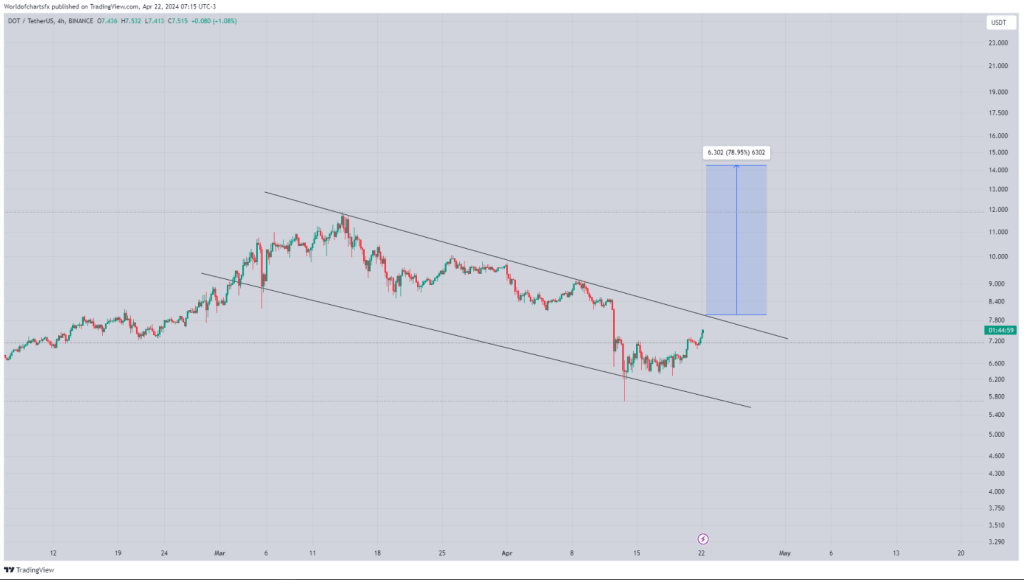

Trading volume also leans bearish, with sellers dominating the market and putting downward pressure on the price. Support seems to be holding around $6.30, but resistance sits stubbornly at $9.40, hindering any upward movement.

Polkadot Consolidation Or Correction?

However, not everyone is ready to count DOT out. Proponents point to a bullish flag pattern, suggesting a consolidation phase. This consolidation, they argue, is a healthy pause after recent fluctuations and allows for accumulation before the next significant price move.

This interpretation finds support from prominent crypto analysts like World of Charts. They believe the current price action is a bullish flag, a technical pattern often seen as a precursor to a breakout. Should this breakout occur, they predict a surge in value, with DOT potentially reaching $15 in the coming weeks.

$Dot#Dot Consolidating In Bullish Flag In H4 Timeframe Expecting Upside Breakout & Incase Of Successful Breakout Expecting Move Towards 15$ In Coming Weeks #Crypto pic.twitter.com/nZkfjMoeDL

— World Of Charts (@WorldOfCharts1) April 22, 2024

Uncertain Future For Polkadot?

The conflicting technical signals make Polkadot’s future trajectory difficult to predict. The short-term outlook appears shaky, with potential for a price dip in the coming days or weeks.

However, the long-term picture remains more optimistic. Polkadot’s core technology offers a compelling solution for blockchain interoperability, a major hurdle in the crypto industry. If the project continues to develop and gain traction, a significant price increase in the future remains a possibility.

While the potential for a $15 price tag in the coming weeks is enticing, the current technical indicators suggest caution. Ultimately, the price of Polkadot, like all cryptocurrencies, remains highly volatile and susceptible to unforeseen events. The coming weeks will be crucial in determining whether the bulls or the bears will prevail in this ongoing battle.

Polkadot JAM Protocol: Integrating Ethereum Smart Contracts, Boosting DOT’s Potential

In another development, Polkadot has been at the forefront of blockchain innovation, drawing significant attention from industry stakeholders with recent developments and promising future prospects. A notable milestone is the unveiling of the Join-Accumulate Machine (JAM) Gray Paper, representing a fusion of Polkadot and Ethereum protocols.

This protocol, as explained by the team, aims to establish a global singleton permissionless object environment akin to Ethereum’s smart-contract ecosystem, while also integrating secure sideband computation parallelized across a scalable node network, a concept pioneered by Polkadot.

Moreover, the JAM protocol introduces a crucial service supporting existing parachains, allowing developers to continue utilizing Substrate for blockchain deployment.

This integration of Polkadot’s infrastructure with Ethereum’s smart contract capabilities and its commitment to DOT underscores a strategic alignment towards interoperability and scalability, potentially reshaping the landscape of decentralized applications and blockchain development.

Featured image from Pexels, chart from TradingView