The CMO, the brainchild of technical analysis pioneer Tushar Chande, is a momentum indicator residing within the MT4 platform. Introduced in his acclaimed book, “The New Technical Trader,” the CMO gauges the relative strength or weakness of a market by analyzing price movements over a chosen period. Think of it as a compass that helps you navigate the ever-changing tides of the market.

A Brief History of the CMO

The 1990s witnessed a surge in the development of innovative technical analysis tools. Tushar Chande, a renowned author and trader, emerged as a frontrunner in this movement. In 1994, he unveiled the CMO, offering traders a novel way to assess market momentum and identify potential buying and selling opportunities. Since its inception, the CMO has garnered a loyal following among technical analysts, particularly those who favor a momentum-based approach to trading.

Understanding the CMO Formula and Calculation

Breakdown of the CMO Formula

The magic behind the CMO lies in its unique formula. It calculates the difference between the sum of recent gains (“Up”) and the sum of recent losses (“Down”) relative to the total price movement over a specified period (often referred to as the “lookback period”). Here’s the breakdown:

- CMO = (Up-Down) / (Up + Down)

- Up = Sum of price differences during bullish periods (closing price higher than the previous closing price)

- Down = Sum of price differences during bearish periods (closing price lower than the previous closing price)

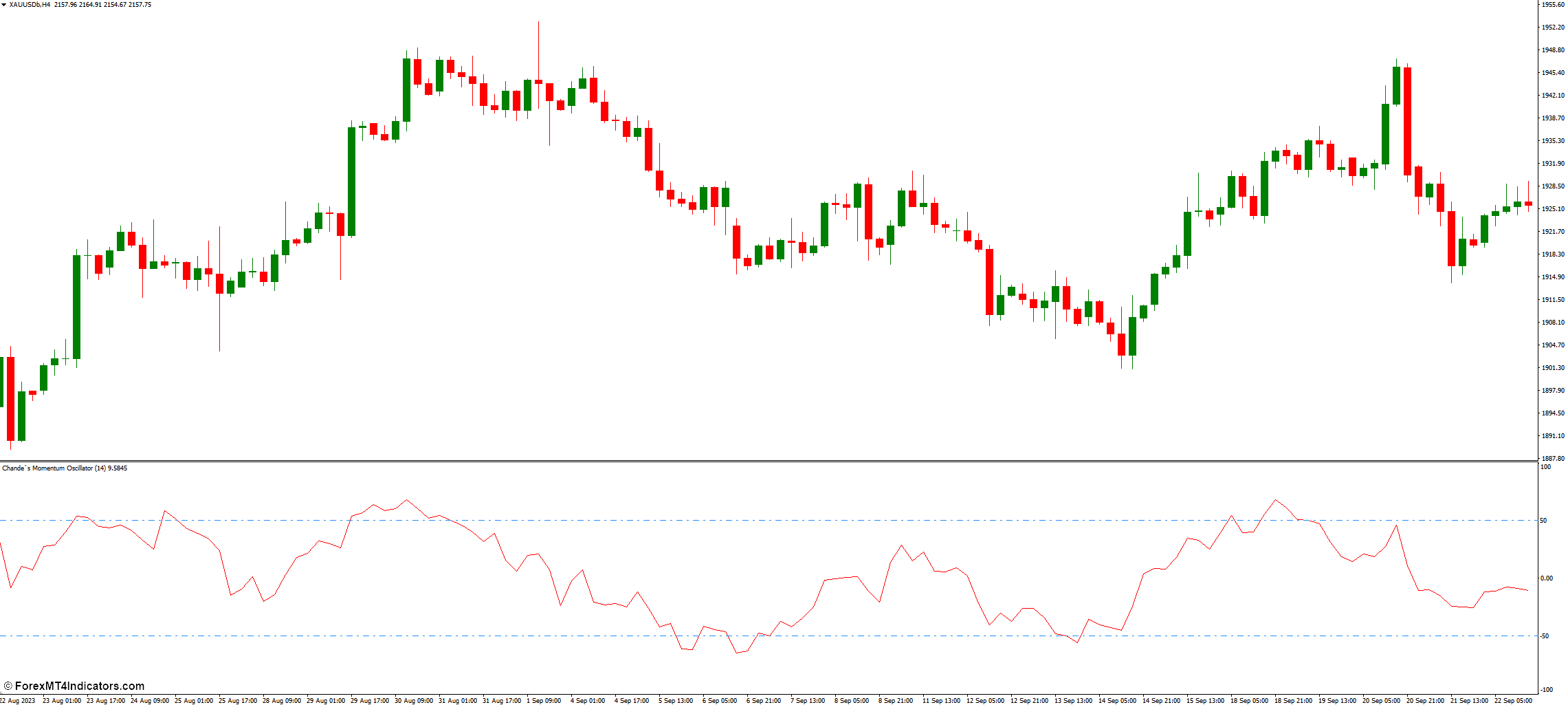

Interpreting the CMO Values

The CMO oscillates between a specific range, typically -100 and +100. Positive CMO values indicate bullish momentum, while negative values suggest bearish momentum. However, the true power of the CMO lies in identifying extremes within this range.

Here’s a simplified interpretation:

- CMO Values Above +50: Potentially overbought conditions, indicating a market that may be due for a correction. (This is not a guaranteed sell signal and further confirmation is recommended.)

- CMO Values Below -50: Potentially oversold conditions, suggesting a market that may be ripe for a rebound. (This is not a guaranteed buy signal and further confirmation is recommended.)

Using the CMO for Trade Signals

Identifying Overbought and Oversold Conditions

As mentioned earlier, the CMO excels at highlighting potential overbought and oversold zones. When the CMO spikes above +50, it suggests the market might be overheated, potentially leading to a price correction. Conversely, a plunge below -50 might indicate oversold conditions, hinting at a possible price reversal. These signals, however, should not be considered trading gospel in isolation.

Recognizing Bullish and Bearish Divergences

The CMO shines even brighter when combined with price action. Look for divergences between the CMO and the price chart. A bullish divergence occurs when the price creates a lower low, but the CMO forms a higher low. This suggests underlying buying pressure that may eventually push prices higher. Conversely, a bearish divergence emerges when the price forms a higher high, but the CMO prints a lower high.

This could signal waning bullish momentum, potentially leading to a price decline. While divergences are powerful tools, they don’t guarantee a price reversal. Always consider them in conjunction with other technical indicators and overall market context.

Combining the CMO with Other Indicators

The beauty of technical analysis lies in its versatility. The CMO thrives when paired with complementary indicators that offer a more holistic view of the market. Here are some potential partners for the CMO:

- Moving Average Convergence Divergence (MACD): The MACD confirms trend strength and potential reversals, adding another layer of validation to CMO signals.

- Relative Strength Index (RSI): Similar to the CMO, the RSI gauges market momentum. Using both indicators can provide a more robust assessment of overbought and oversold conditions.

- Support and Resistance Levels: These key price points, identified through historical price action, can act as confluence zones for CMO signals, bolstering their reliability.

Advantages and Limitations of the CMO

Benefits of the CMO for Traders

- Intuitive Interpretation: The CMO’s visual representation and straightforward concept make it easy to understand, even for novice traders.

- Momentum Identification: The CMO excels at pinpointing periods of strong buying or selling pressure, offering valuable insights into market strength.

- Divergence Detection: The ability to identify divergences between the CMO and price action empowers traders to anticipate potential trend reversals.

- Customization Options: MT4’s flexible settings allow traders to personalize the CMO to their trading style and market conditions.

Potential Drawbacks to Consider

- False Signals: Like all technical indicators, the CMO can generate false signals, especially in volatile markets. Confirmation from other indicators is crucial.

- Market Dependence: The CMO’s effectiveness can vary depending on market conditions. It may be less reliable in ranging markets with minimal directional movement.

- Overreliance: Solely relying on the CMO can lead to missed opportunities. Utilize it as part of a comprehensive trading strategy, incorporating other tools and fundamental analysis.

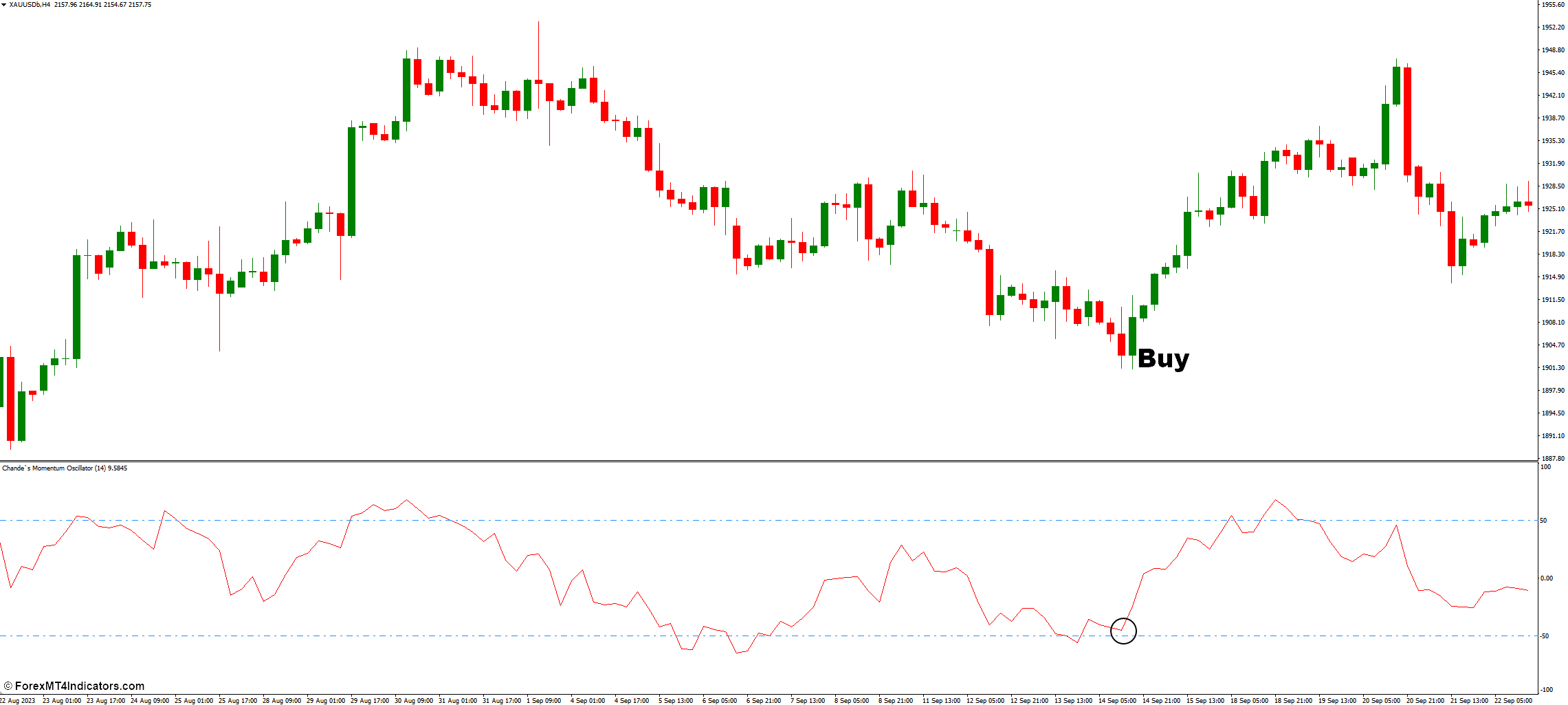

How to Trade with Chande Momentum Oscillator Indicator

Buy Entry

- Look for the CMO line to cross above a short-term moving average (e.g., 20-day MA) while the price is in an uptrend.

- Entry: Buy when the price breaks above a recent swing high.

- Stop-Loss: Place a stop-loss order below the recent swing low.

- Take-Profit: Target a profit level based on your risk-reward ratio or consider taking profits when the CMO reaches overbought territory (experiment with different thresholds above +50).

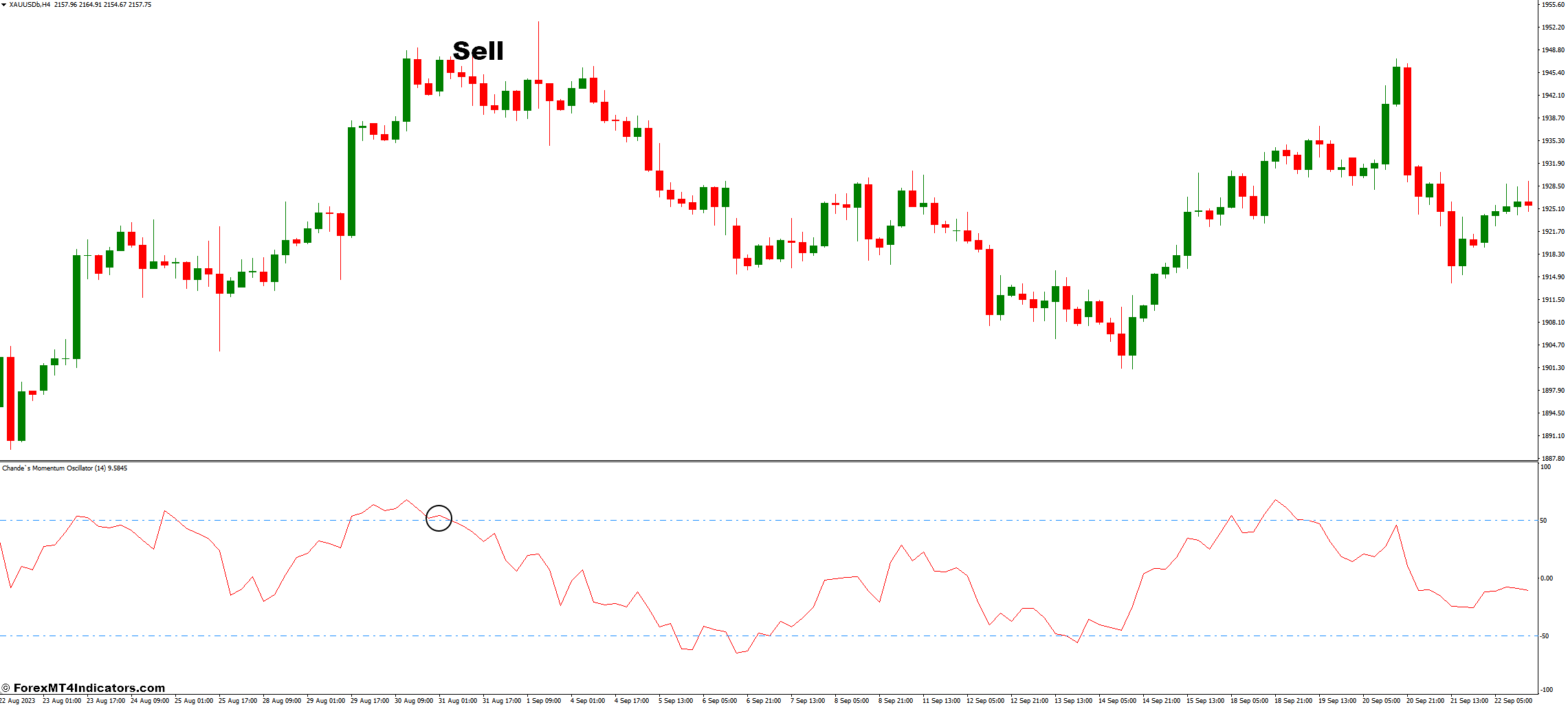

Sell Entry

- Look for the CMO line to cross below a short-term moving average (e.g., 20-day MA) while the price is in a downtrend.

- Entry: Sell when the price breaks below a recent swing low.

- Stop-Loss: Place a stop-loss order above the recent swing high.

- Take-Profit: Target a profit level based on your risk-reward ratio or consider taking profits when the CMO reaches oversold territory (experiment with different thresholds below -50).

Conclusion

CMO equips you with a valuable tool to gauge market momentum, identify potential overbought and oversold zones, and spot divergences that might foreshadow trend reversals. Its user-friendly interface and customizable settings make it an attractive option for both new and experienced traders.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: