Quick Take

- Credit rating agency Moody’s has downgraded the crypto exchange Coinbase from “stable” to “negative.”

- This decision comes after the June 6 lawsuit from the SEC.

- However, despite the rating downgrade, Moody’s rating rationale on their website does acknowledge their “healthy liquidity position.”

“The affirmation of Coinbase’s ratings reflects its healthy liquidity position, its recent cash flow generation improvements stemming from prudent expense management, and because the SEC’s charges pertain only to some of Coinbase’s products, and exclude its leading traded products.”

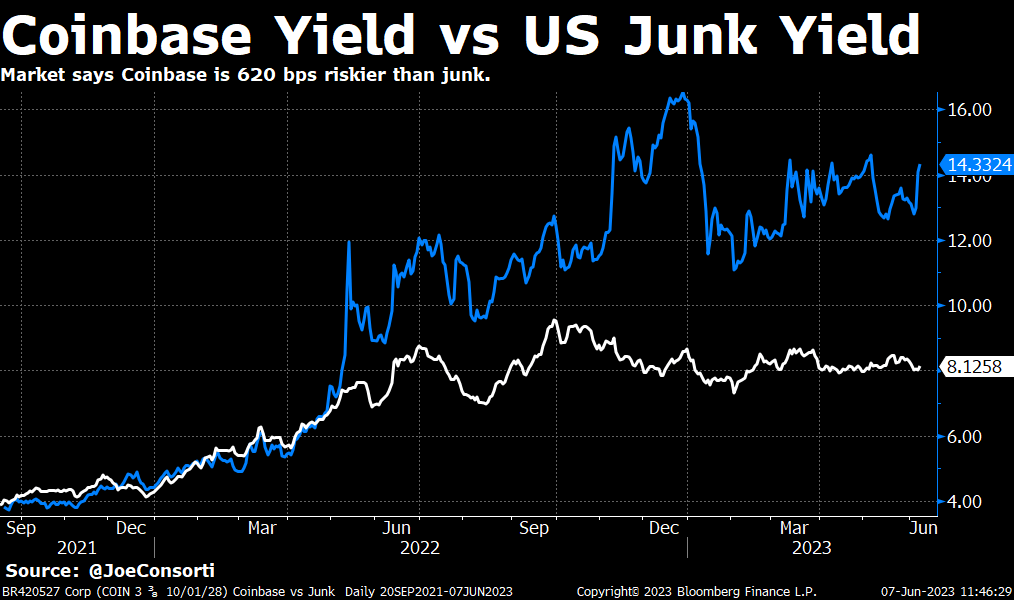

- In addition, macro analyst, Joe Consorti from the Bitcoin Layer, pointed out that Coinbase debt is selling off rapidly. Joe goes on to say

“It yields 14.3% and climbing, which is 1.75x higher than the 8.1% most of America’s junk corporations have to borrow at. The market is saying that Coinbase is 620 bps riskier than junk.”

- Coinbase share price is currently trading at $54.90 but -16% down in the past five days.

The post Coinbase outlook downgraded from stable to negative – Moody’s appeared first on CryptoSlate.