Market Overview: DAX 40 Futures

DAX futures went down last week with some profit-taking after a tight bull channel. We are still always in long, but we raced past 18000, and we might need to stop there for bulls to recover from the move up. It is an outside down bar, so a weak sell signal, but some bears will look for a follow-through and fade a breakout of that. Most traders should be long or flat and waiting for a good stop entry in line with the always-in direction.

DAX 40 Futures

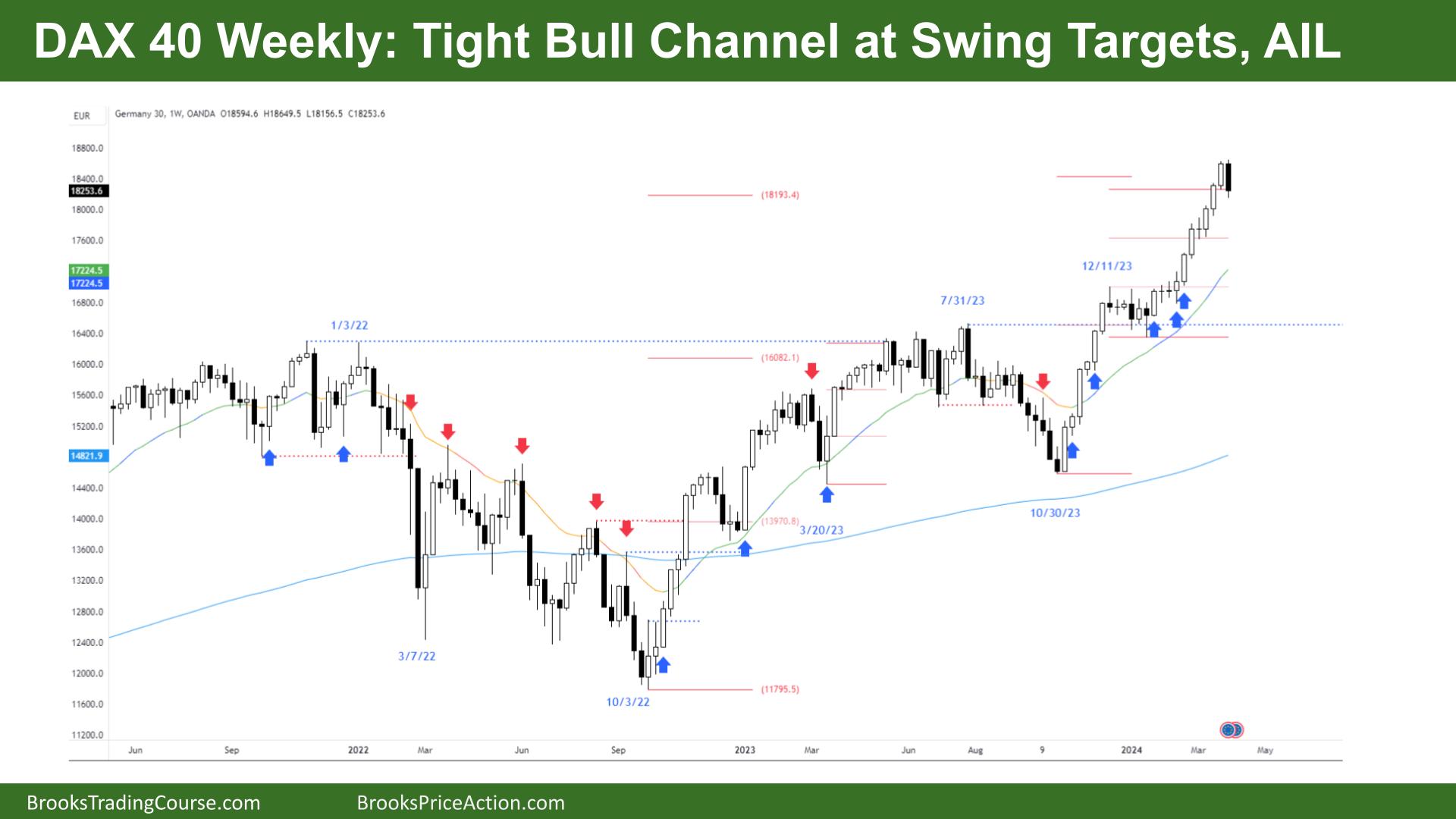

The Weekly DAX chart

- The DAX 40 futures went lower last week with profit-taking in a tight bull channel.

- We reached swing targets from the wedge bottom and the higher low breakout of the prior trading range.

- It was a 7-bar bull microchannel before last week, and we said higher probability is a pullback rather than more up.

- Low 1 in a tight bull channel, so probably bull scalpers below.

- Because we raced through the targets bulls will likely get another chance to hit that measured-move target.

- It is an outside-down bear bar, so there is a weak short below. That is because there is also a bull breakout above the bar.

- Bears need follow-through, but not for a sell below. The follow-through will likely lead to a second attempt at a short scalp. The entry would be expecting the High 1 to fail.

- Bear targets would be the bull doji back a few weeks.

- We then said to expect a trading range within 3 – 5 bars. We got the start of it in 3.

- There are more measured move targets above, but its climactic and likely an overshoot of other targets.

- The pullback is likely to be stronger because there were no limit order trades on the way up – buying below bars.

- Lower probability is to have another tight trading range like in November. But it is 2 legs.

- Usually, after the second leg, a deeper two-legged correction occurs. The bears want it down to the moving average.

- Bulls can exit below this week.

- Always in long, so expect sideways to up. Bears want good follow-through for the correction to start, but it’s unlikely.

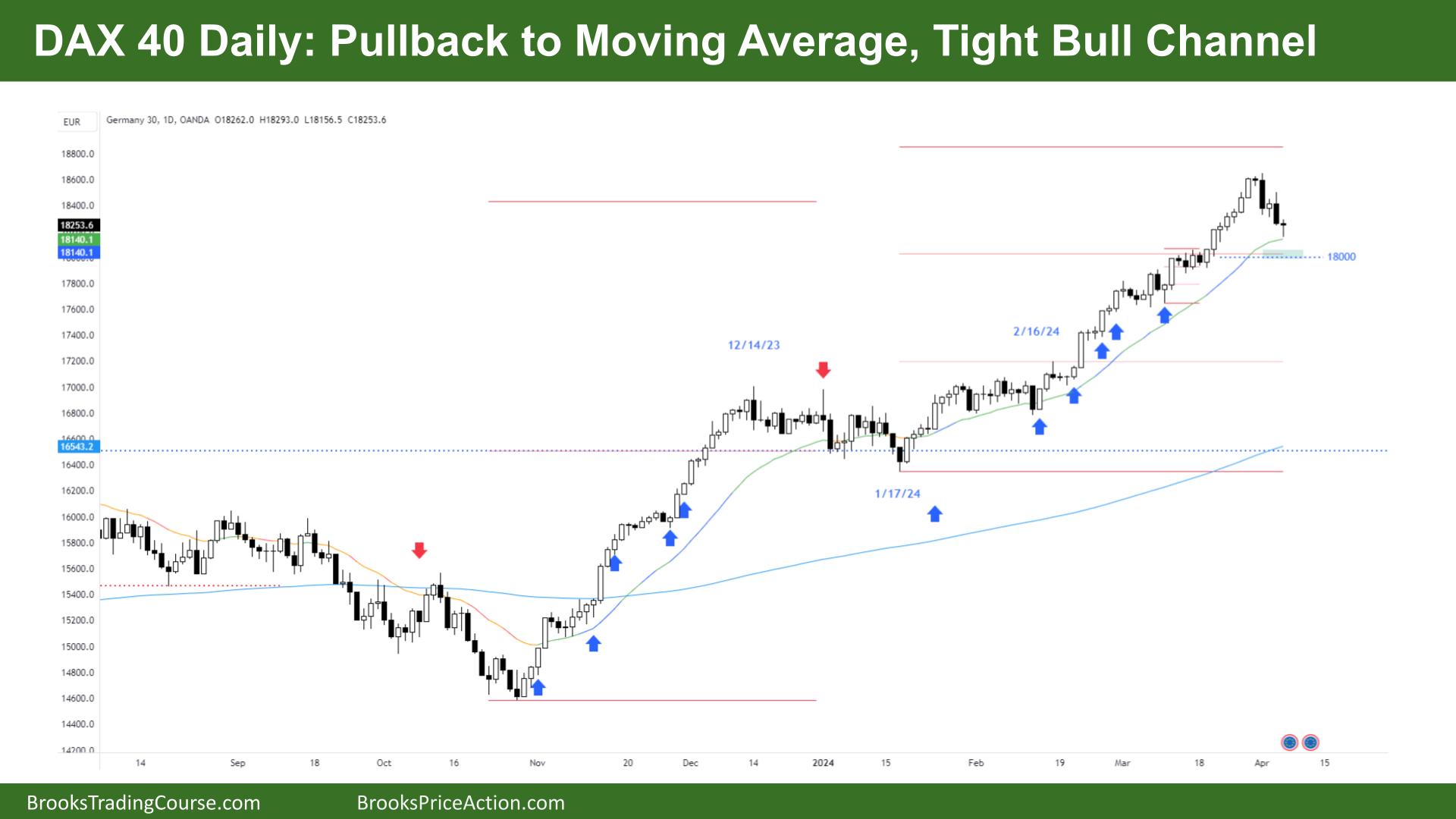

The Daily DAX chart

- The DAX 40 futures went lower on Friday with a bear doji above the moving average.

- The bulls see a pullback to the moving average after a strong bull spike.

- But the spike comes right at the end of a bull move.

- So, both bulls and bears will probably see a climax and expect a two-legged correction.

- Small pullback bull trend characteristics, so likely buyers at the moving average.

- There was a possible final flag at 18000, I said earlier that I thought we would come back and we are within scalping distance on the weekly chart from it.

- I’m not recommending short for most traders, but I certainly do not want to sell below anything on this chart yet.

- It was a cheeky High 1 fade above Wednesday, a trade I like to take late in a trend.

- Bulls want a second entry buy signal near the MA, but most traders should wait for it to stop going down and start to flatten out.

- 18000 is where the last clear higher low broke through the trading range.

- Bulls might also argue a parabolic wedge top, three pushes up in that last spike, so two legs and then a move up.

- The PWT is 7 bars, so we might need the same again to correct.

- Can we break 18000 and go down? There is lower portability at this stage just because the higher time frames are so bullish. I think most bears want to sell into the bar, midpoint, or above.

- You can see with the tail on Friday front running bulls, or bear scalpers are buying, so be careful selling here.

- Expect sideways to down to the moving average next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.