The world’s largest asset manager continues to embrace crypto.

Yesterday, it was revealed (here is the SEC filing) that BlackRock has created a fund called the BlackRock USD Institutional Digital Liquidity Fund that will be launched in partnership with Securitize.

Now, Securitize is all about tokenization of real-world assets (listen to my podcast with the Securitize CEO from 2022) and they are backed by some of the biggest names in finance. But to get on board with BlackRock has to be a real coup for the company.

While there is not much in the way of details, crypto sleuths have discovered an unconfirmed digital wallet on Ethereum showing $100 million of Circle’s USDC stablecoin related to Securitize. Some think this could be seed money for this fund.

It will be interesting to see what type of assets this fund will ultimately hold. Stay tuned for when they officially launch the fund.

Featured

> BlackRock Creates Fund With Securitize, a Big Player in Real-World Asset Tokenization

By Krisztian Sandor

The fund was seeded with $100 million in USDC stablecoin using the Ethereum network, blockchain data shows.

From Fintech Nexus

> How AI Can Help Americans Achieve Financial Freedom in 2024

By Dusten Salinas

It’s impossible to escape a headline about generative AI these days, with many business leaders opining on its potential either to exponentially boost productivity or to destroy our workforce as we know it. Yet too few thought leaders have pointed to how generative AI can be harnessed to support everyday people in their journey to financial independence – especially the millions of Americans currently living paycheck to paycheck in an unusually shaky economy.

Podcast

Dan Arlotta, Senior Vice President of Garnet Capital Advisors on fintech loan portfolio sales

The secondary loan market has played an important role in the history of fintech lending. There are few people who know more…

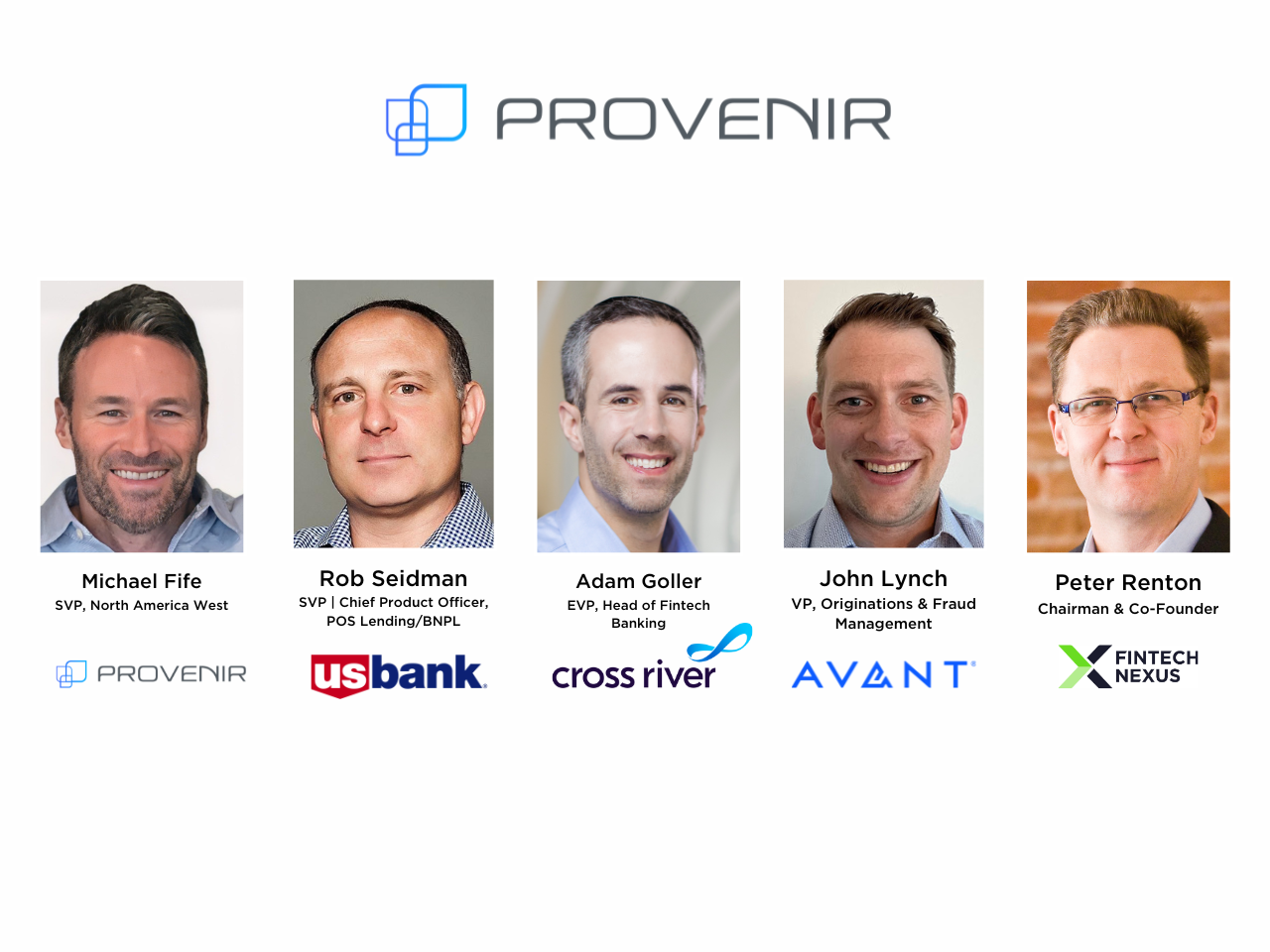

Webinar

How Consumer Lenders Can Reduce Friction Without Compromising on Risk and Fraud Prevention

Mar 21, 2pm EDT

Customer experience is incredibly important to today’s discerning consumers, whether they are looking for financial services…

Also Making News

- Global: The most innovative blockchain, crypto, metaverse, and Web3 companies of 2024

Why Roblox, Coinbase, Visa, and Securitize are among Fast Company’s Most Innovative Companies in blockchain, crypto, metaverse, and Web3 for 2024.

- Europe: Solaris raises €96 million in funding

German Banking-as-a-Service outfit Solaris has raised €96 million in a Series F funding round and secured a financial guarentee of up to €100 million capital equivalent which will enable it to execute on a major credit card contract with Munich-based motor association Adac.

- USA: Some crypto legislation is ready for House floor, Rep. Emmer says

Rep. Tom Emmer, R-Minn., majority whip of the U.S. House, says Financial Services Committee Chairman Patrick McHenry’s digital market structure bill could be ready for a vote in the full chamber.

- USA: FTC fines fintechs Biz2Credit, Womply $59M over PPP actions

The agency claimed Biz2Credit misrepresented the timeline for application processing, and Womply had inadequate customer service in the COVID-era crunch for small-business loans.

- USA: Ramp CEO says the fintech startup is just scratching the surface

Ramp has grown into a $5.8 billion business but CEO Eric Glyman says they’ve only tapped into 1% of the total addressable market.

- Global: The pros and cons of digital identities

Thirty years ago, I presented at a conference with the theme being the end of cash. Thirty years later we are all gradually going cashless. Twenty-five years ago, I presented at a conference, with the view that bank branches weren’t needed. Twenty-five years later, most bank branches are going, going, gone.

- LatAm: Colombian Fintech Addi Secures $86M in Funding Round Led by Goldman Sachs and Singapore’s GIC

Buy-now, pay-later app reaches 2M users, but valuation takes a hit.

- USA: Apex Stock Rewards API Receives New Patent Approvals

Revolutionary technology enables consumer brands to reward loyal customers with stocks.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.