One of the reasons why many traders lack the accuracy needed to become consistently profitable is because many traders try to trade against the flow of the market. In other words, they are trading against the trend. Smart trend following traders on the other hand know that trading in the direction of the trend significantly increases the chances that the direction of the trade would be right. This is why the statement, “Trade with the trend…,” carry a lot of wisdom in it.

Trend continuation strategies is a type of trend following strategy wherein traders trade in the direction of an established trend. In contradiction to a trend reversal strategy, which aims to enter the market as the trend reverses, trend continuation strategies wait for the trend to be clearly established. Then, trades are taken in the direction of the established trend as the market gives favorable price opportunities.

Trend continuation strategies are very effective because it produces trade setups that have very high win probabilities. This is because trading in the direction of the trend means that the market’s long-term momentum is in your favor. The trades taken are not a fight against the flow of the market, rather the trades flow in the direction that the market is moving.

In this strategy, we would be looking at how a simple momentum indicator can be used to identify excellent trend continuation entry points.

100 Pips Momentum

100 Pips Momentum or Oracle Move is a custom technical indicator which was developed to help traders identify the short-term trend or momentum of the market. It is based on a pair of modified moving average lines which are characteristically very responsive to price action movements, while at the same time tend to retain the smoothness of its responses. This allows for a timely indication of a trend reversal while at the same time avoiding much of the false signals which may be cause by a choppy market.

This indicator plots two moving average lines. The faster moving average line is blue, and the slower moving average line is red. The market momentum is bullish if the blue line is above the red line, and bearish if the blue line is below the red line. Consequently crossovers between the two lines can be used as an entry signal.

Given the nature of this indicator, it is best used as a momentum reversal signal indicator. However, it would also be an advantage if the trades are in confluence with other indications such as a bounce from a major support or resistance level or the trade direction agrees with a long-term trend.

Kumo (Ichimoku Kinko Hyo)

The Ichimoku Kinko Hyo indicator is a unique technical indicator because it is in itself a complete trading system. It provides traders with a 360-degree perspective as to what the market trend looks like. It identifies the short-term trend, mid-term trend, and long-term trend based on multiple averages based on the median of price action within various periods.

The Kumo is an integral component of the Ichimoku Kinko Hyo system. This is because the Kumo represents the long-term trend direction.

It is composed of the Senkou Span A (Leading Span A) and Senkou Span B (Leading Span B) lines.

Senkou Span A is the average of the Tenkan-sen and Kijun-sen lines, both underlying components of the Ichimoku Kinko Hyo system, representing the short-term and mid-term trends.

Senkou Span B on the other hand is simply the median of price action over the past 52 periods plotted 26 periods ahead.

The long-term trend direction can be based on how these two lines interact. The trend is bullish if Senkou Span A is above Senkou Span B, and bearish if Senkou Span A is below Senkou Span B. As such, crossovers between the two may be interpreted as a long-term trend reversal. However, this indicator is best used as a trend direction filter used to help traders avoid trading against the long-term trend.

Trading Strategy

Kumo Oracle Trend Continuation Forex Trading Strategy is a simple trend continuation strategy which is based on the agreement of the long-term trend and the short-term momentum based on the two indicators mentioned above.

The Kumo is used as a basis for the long-term trend. This is based on how the Senkou Span A and Senkou Span B lines overlap.

The Oracle Move indicator on the other hand is used as the entry signal based on the short-term momentum which agrees with direction of the long-term trend. This is simply based on the crossing over of the two lines indicating a momentum reversal which coincides with the long-term trend as indicated by the Kumo.

Indicators:

- Ichimoku

- 100pips Momentum

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

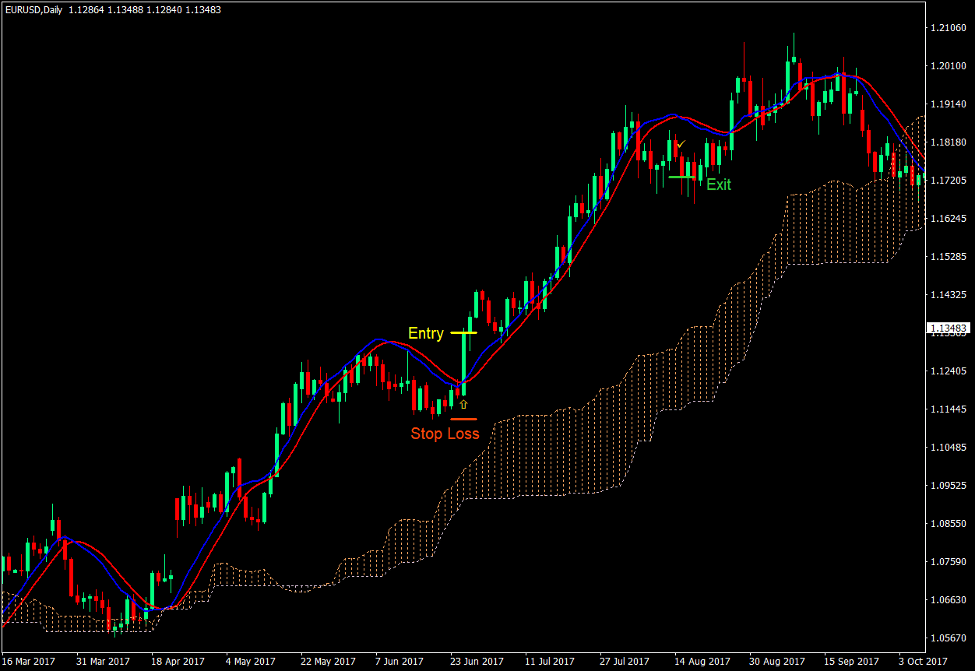

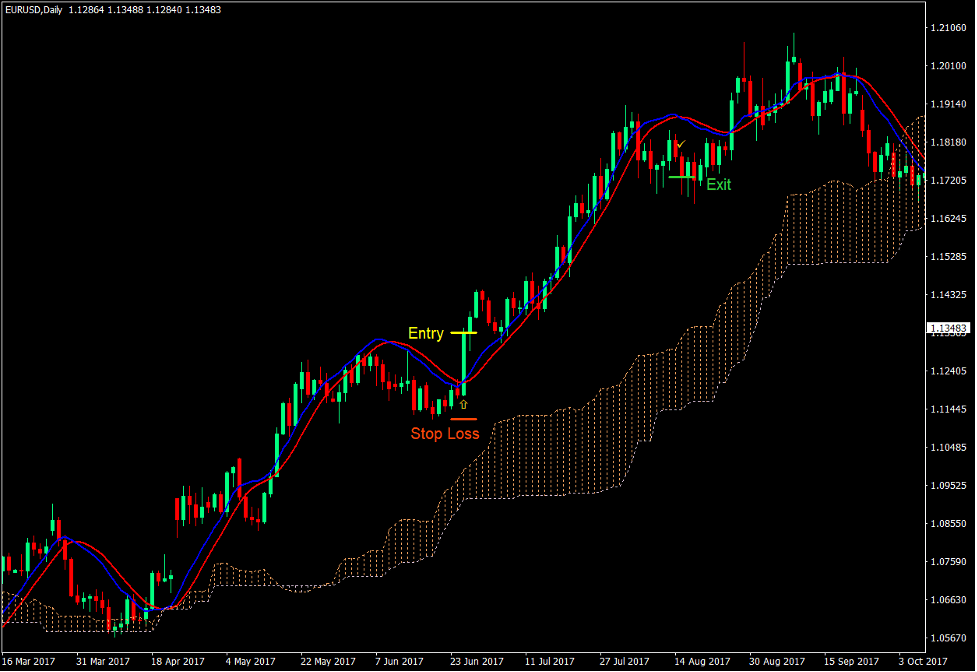

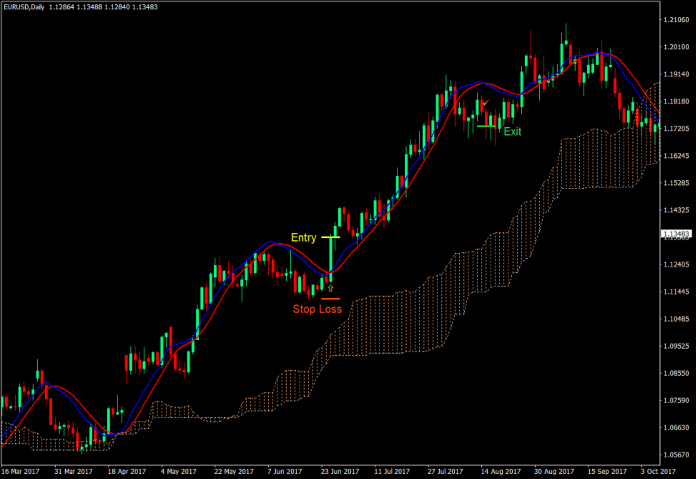

Buy Trade Setup

Entry

- The Senkou Span A (brown) line should be above the Senkou Span B (thistle) line.

- Price action should plot rising swing points indicating an uptrend.

- Price should retrace and cause the Oracle Move lines to temporarily reverse.

- Enter a buy order as soon as the blue Oracle Move line crosses above the red line.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the blue Oracle Move line crosses below the red line.

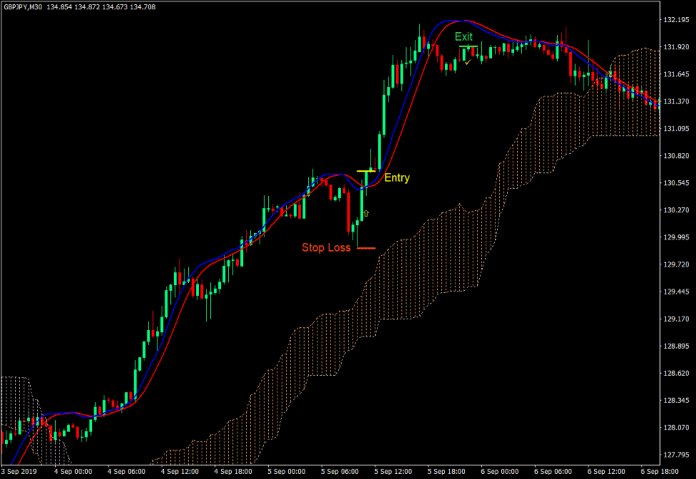

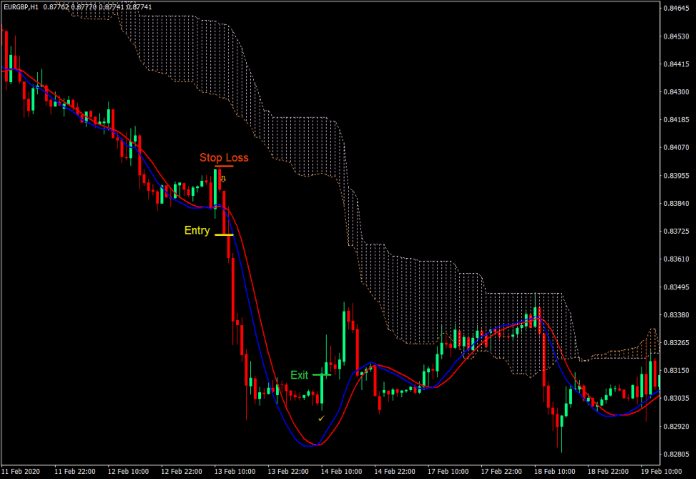

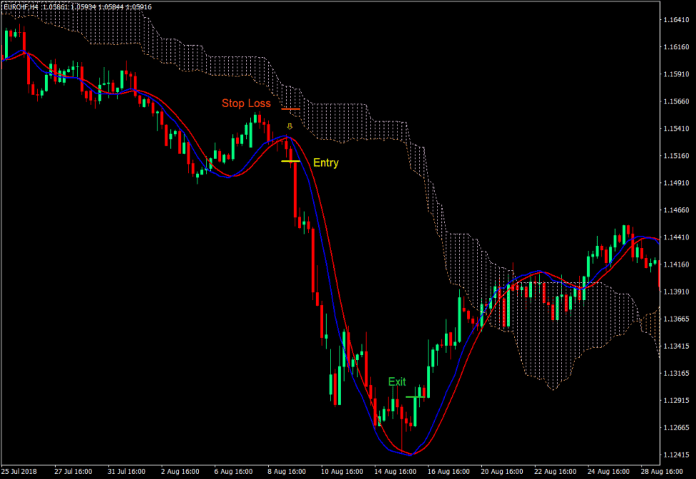

Sell Trade Setup

Entry

- The Senkou Span A (brown) line should be below the Senkou Span B (thistle) line.

- Price action should plot dropping swing points indicating a downtrend.

- Price should retrace and cause the Oracle Move lines to temporarily reverse.

- Enter a sell order as soon as the blue Oracle Move line crosses below the red line.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the blue Oracle Move line crosses above the red line.

Conclusion

This trading strategy is a high probability trading strategy based on a simple trend continuation trade setup.

The Kumo is a widely used basis for the long-term trend. The Oracle Move on the other hand is a very responsive short-term momentum indicator. Trading based on the confluence of these two complementary indicators can potentially produce high probability trade setups, which traders can use to consistently profit from the market.

Forex Trading Strategies Installation Instructions

Kumo Oracle Trend Continuation Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Kumo Oracle Trend Continuation Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Kumo Oracle Trend Continuation Forex Trading Strategy?

- Download Kumo Oracle Trend Continuation Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Kumo Oracle Trend Continuation Forex Trading Strategy

- You will see Kumo Oracle Trend Continuation Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download: