Popular strategies to follow with the Advanced CCI Trading robotool

The Simple CCI and the Advanced CCI trading robots and tools were created in order to help you achieve your goals and win in the markets, not by giving you an unknown magical formula, or an “AI” that will predict the future for you. They were designed in order to give you plenty of options to create your own strategies.

We believe that the human has to be above any robot, and by doing so, the human will earn not only the profits of his strategy (if he succeeds) but also the mental satisfaction that he did succeed. If not, he earns from knowledge and he becomes a better and wiser trader.

In this article we’re gonna see some of the popular strategies that you can follow just to help you kickstart your own journey by using these “robo-tools’.

Product: https://www.mql5.com/en/market/product/97538

Strategy 1 – “Swing CCI”

You can follow this strategy with both robots, so if you don’t have money to purchase the Advanced CCI, we got your back mate! You can download the free “Simple CCI” trading robot.

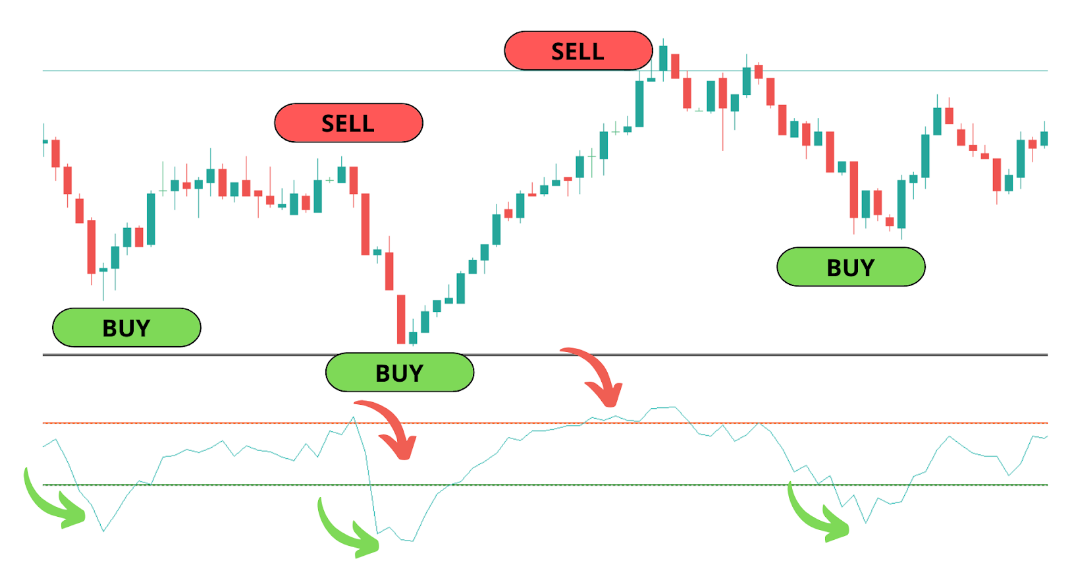

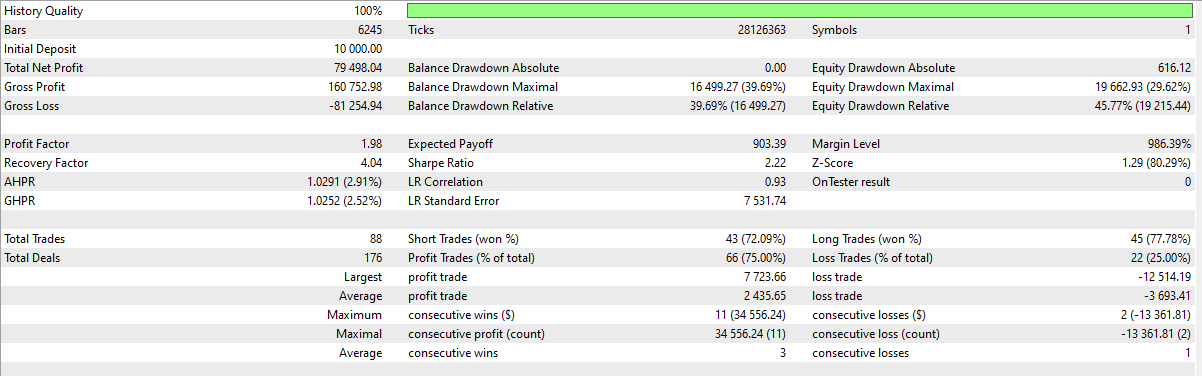

The idea is very simple. Buy when you cross above or below a CCI level, close and sell on another level.

Let’s see a simple example by using an image:

In both robots there’s no option to not add a stop-loss or a take-profit level. No matter what, we believe that a stop-loss must be there, somewhere. Anything could happen, Murphy’s law is very closely related with trading, so in order to follow this strategy you will have to add the SL and TP levels far away from the entry price. And this is because we need to give the market some space to breathe. Let’s enter the market when we get an oversold signal (buy) and exit and sell when we get an overbought signal.

Even if the market starts trending towards one direction, the loss will be probably the minimum as we’re gonna exit at a strong pullback.

You can search through all the available timeframes and you can explore all the assets available from your broker.

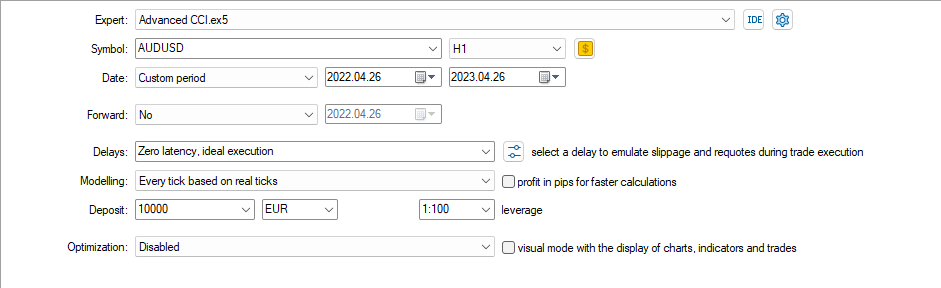

I’d like to give you an example here. Using the AUDUSD – H1 and by adding these inputs:

-

Buy when crossing ABOVE -160

-

Sell when crossing BELOW 160

-

Close open positions at opposite signal: TRUE

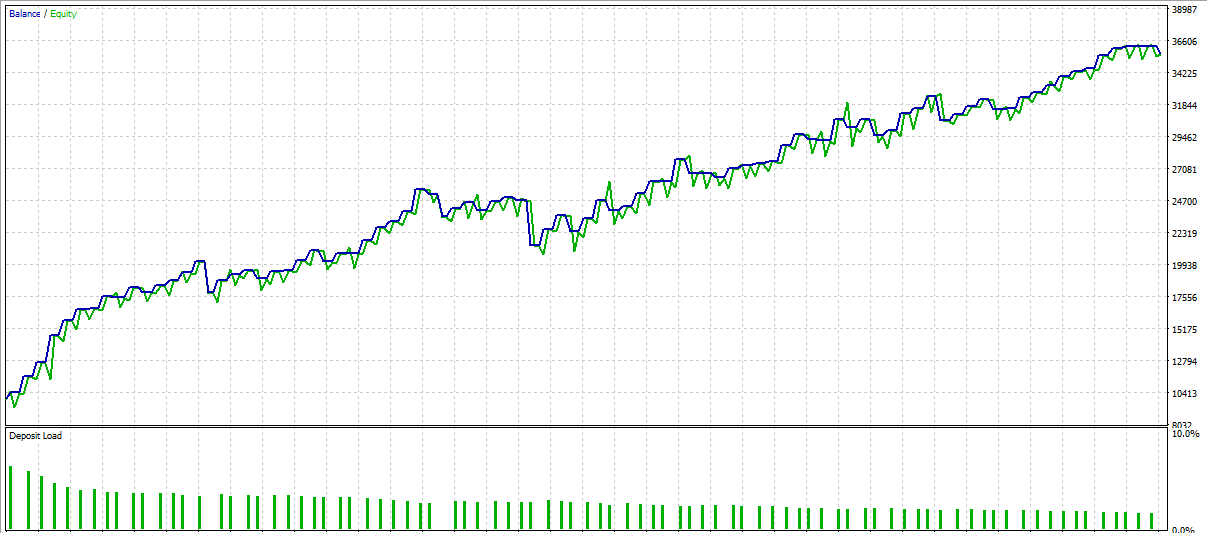

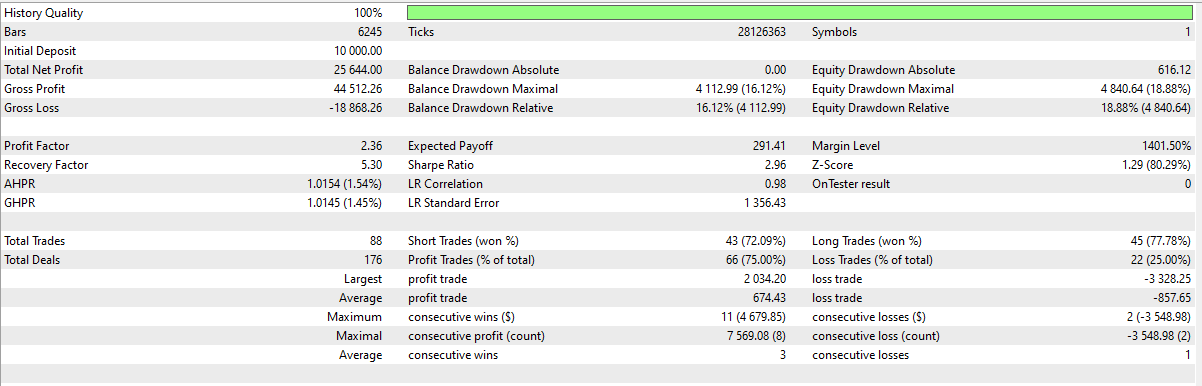

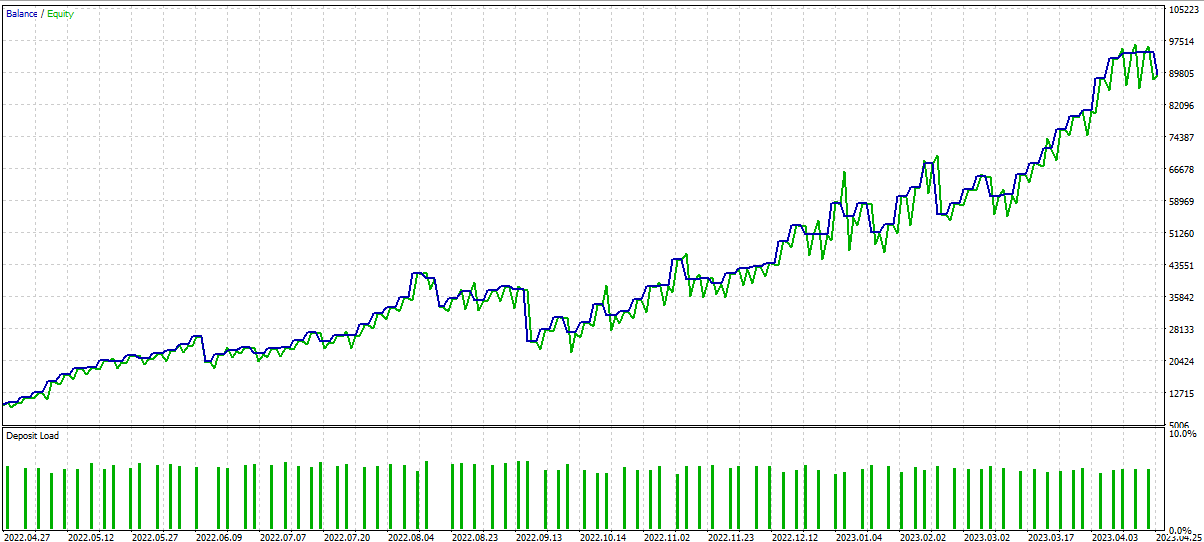

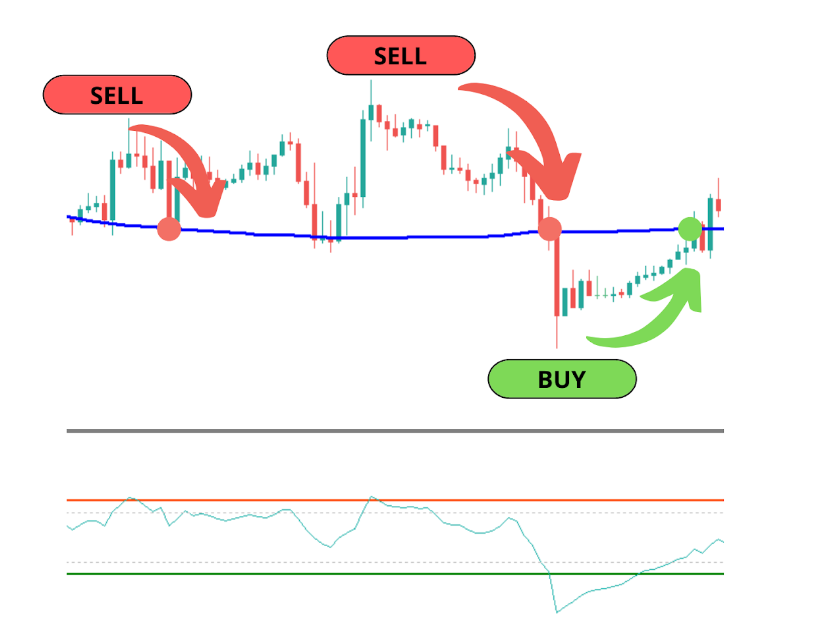

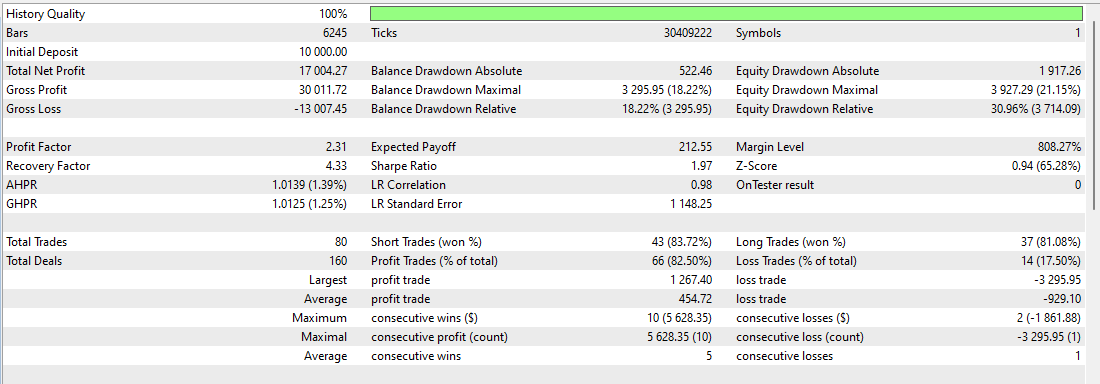

Let’s check the results (Every tick based on real ticks for 1 year)

The result gives us a profit of more than 25,000$ and it turns our 10,000$ account into 35,644$

We can explore more combinations using some of the Advanced CCI robot functionalities, such as the trailing SL, dynamic exit using the “Manage” tab, where we can set a % or a specific amount to stop trading or the dynamic lot size, the result of it I’m sharing below:

From 10,000$ to 89,498$.

Strategy 2 – Mean reversion

Very popular strategy, and one of my favorites, when we expect the market sooner or later to come back to the mean price, aka MA.

In order to follow a strategy like this, we’re gonna enable the MA filter, available only in the Advanced version.

After we have an oversold or overbought signal we’re gonna enter the market, and the target is gonna be a Moving Average of our choice.

Of course we have a weak point and this is when a market is trending. Again we’re gonna exit on the MA, but what happens if the trend is sharp and long. This is why we need a stop-loss again. Different ways for you to choose a good stop-loss level, such as:

-

The nearest high or low (high for sell and low for buy) where you can also add some points, to give an extra space for the recent high/low to act like a support/resistance level.

-

Another way is to use the ATR factor. This way you can add your stop-loss to some bars above or below the entry point.

-

Last but not least, is the most common way, by using a distance in points.

Let’s see an example together.

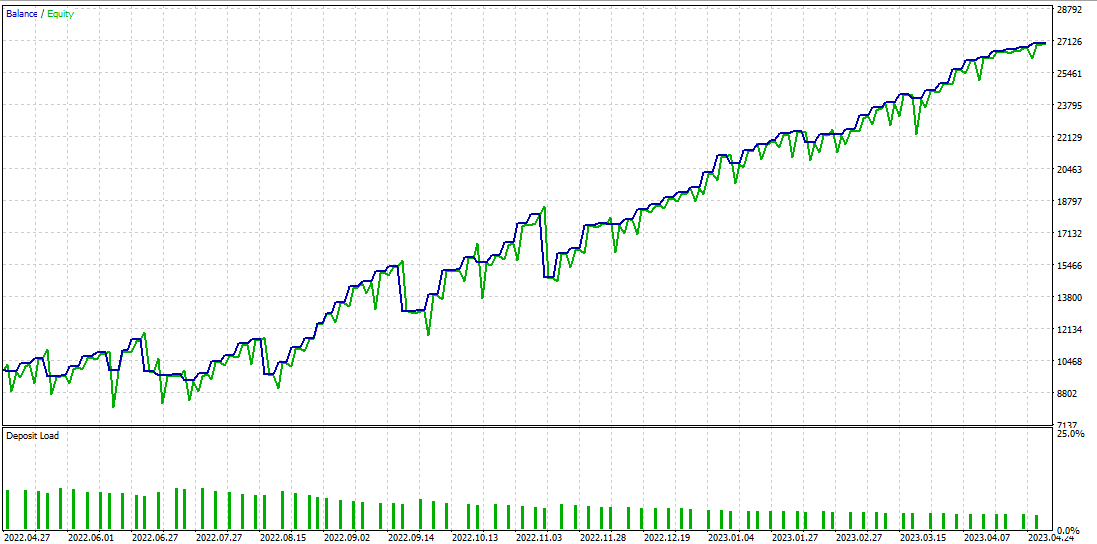

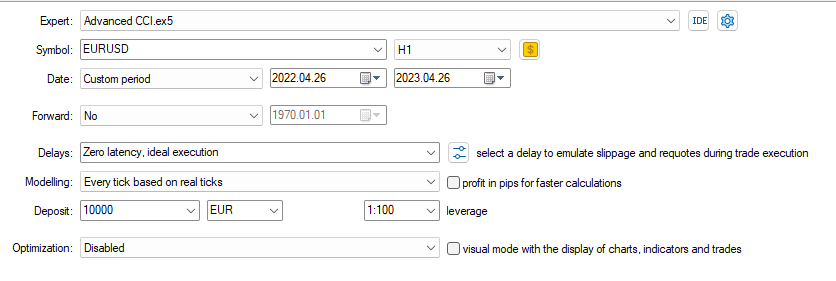

-

Symbol: EURUSD

-

Timeframe: H1

-

Backtest period: 1 year

Results:

Inputs:

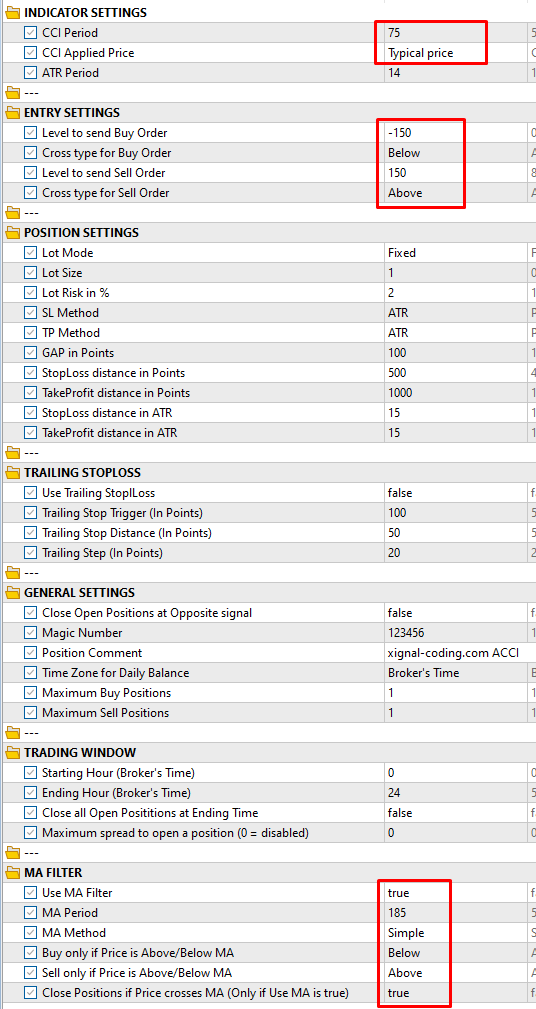

CCI Period: 75

CCI Method: Typical Price

Buy when Price is below the MA and also CCI crosses below -150.

Sell when price is above the MA and CCI crosses above 150 level.

More strategies are coming soon…